|

|

|

An independent view of the world

seen from Tokelau

The Independent New York Times

Tokelau, Saturday,

October 25,

2008 Weekend Edition, editor

- contact sumpinein@gmail.com

|

|

|

|

|

|

GREENSPAN: I

WAS 'PARTIALLY' WRONG ON CREDIT CRISIS |

|

With this incredible

admission former Federal Reserve Chairman Alan

Greenspan told Congress on Thursday he was

"shocked" at the breakdown in U.S. credit

markets and said he was "partially" wrong to

have resisted regulating some securities.

Despite concerns he had in 2005 that risks were

being underestimated by investors, "this crisis,

however, has turned out to be much broader than

anything I could have imagined," Greenspan said

to the House of Representatives Committee on

Oversight and Government Reform. "Those of us

who have looked to the self-interest of lending

institutions to protect shareholder's equity

(myself especially) are in a state of shocked

disbelief," said Greenspan, who stepped down

from the Fed in 2006. While Greenspan was once

hailed as one of the most accomplished central

bankers in U.S. history, the low interest rates

during his final Fed years have now been blamed

for fuelling the housing bubble and the crash

that touched off the current financial crisis. |

|

|

|

A UN study says that in financial

terms currently the loss of forest

equals some US$2 to US$5 trillion every

year. Who is going to do something about

all this? Indonesian authorities have pledged

to stop the loss of forests and species

in Sumatra, one of the world's most

ecologically important islands.

Representatives of the island's 10

provinces, national government and the

environment group WWF launched the deal

at the World Conservation Congress.

Sumatra has lost about half of its

forest cover in the last 20 years. It is

home to a number of important and iconic

species such as the tiger, orangutan,

rhinoceros and elephant. The island has

suffered floods and forest fires in

recent years that have been widely

attributed to illegal forest clearance.

Two years ago, President Susilo Bambang

Yudhoyono was forced to apologise to

Singapore and Malaysia when smog from

burning Sumatran forest covered the

neighbouring countries. The need to deal

with these issues appears to have played

a big part in persuading the authorities

to act. "In the rainy months, we are

seeing landslides and flooding more

often, and it is time to make a real

change," said Indonesia's deputy

environment minister Hermien Roosita at

a news briefing here. "Every governor

from the 10 provinces and four

(national) ministries have signed this

monumental commitment to ecosystem

restoration of the island and protecting

the remaining natural forest." More than

13% of the island's forests lie on peat,

which contain vast amounts of carbon

that would be lost to the atmosphere if

the trees were removed, accelerating

climate change. "When you look at the

flora and fauna in this area and the

rate of loss that's going on, this is a

substantial commitment to protect and

restore forests," said Gordon Shepherd,

WWF's director of global policy. The

government has already regulated to stop

clearance of virgin forest for palm oil

plantations - grown for food, industry

and biofuels - but the government

acknowledges the ban may not be

completely effective. |

|

|

Read DEATH OF A

FINANCIER by JOHN

FRANCIS KINSELLA |

|

Tom Barton, a City

mortgage broker, decides

to quit his business in

the wake of the subprime

crisis and arrives in

Kovalam, in the south of

India. In the Maharaja

Palace he finds himself

in the company of

holiday makers from the

UK, Scandinavia and

Russia. Stephen Parkly,

the CEO of a successful

City bank, and his young

wife Emma are taking a

well earned year end

break. Parkly falls

gravely ill with a

mysterious infection,

whilst back in the City,

unknown to him his

mortgage and investment

bank, West Mercian

Finance is in grave

difficulties. Ryan

Kavanagh, a doctor,

comes to Emma’s aid with

the help of Barton,

after an attempted

cover-up by the Indian

authorities, who fear

for their tourist

industry and more

especially medical

tourism, as the disease

threatens the resort

with the tourist season

in full swing. Thousands

of British tourists

enjoying the sun are

unaware of the pending

disaster, many are

equally unaware their

savings about are to be

wiped out in the West

Mercian collapse. |

|

Some are

still

spending.... |

|

|

|

|

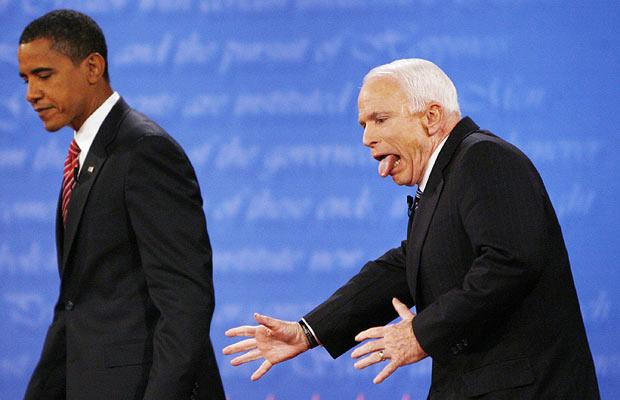

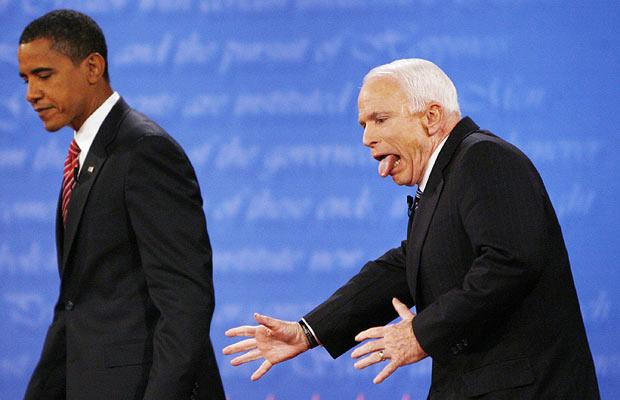

McCAIN TRAILS OBAMA

IN FINAL DAYS |

|

Colin Powell’s

endorsement of

Obama is a

bitter blow to

McCain. It is

getting harder

and harder to

remember the

last time

anything

happened in

Campaign 2008

that John

McCain's camp

would regard as

clear,

unambiguous good

news. Colin

Powell once

tipped as a

presidential

candidate is the

latest leading

figure to

endorse the

presidential

candidate.

McCain has

struggled to

find the right

tone and the

right message

amid a sinking

economy, and

Sarah Palin has

come dangerously

close to running

aground in a

series of

excruciating

interviews on

network

television.

Opinion polls

have also

provided

depressing

evidence that

Barack Obama is

winning the

arguments and -

for the moment

at least -

winning the

election. |

|

|

|

|

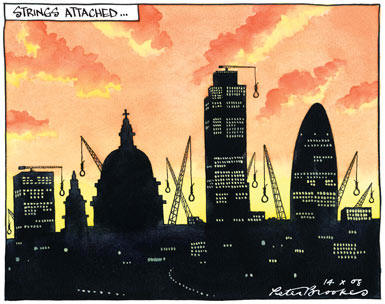

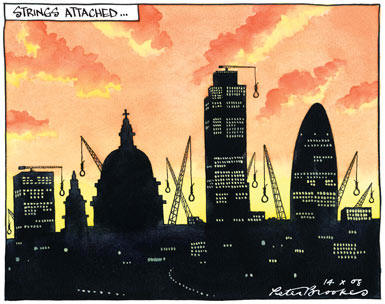

The UK banks

have

traditionally

been net

borrowers in

the world

money

markets,

relying on

banks from

countries

like Japan

to provide

them with

the money

they need.

But the past

year has

seen Libor

rates soar

well above

the official

Bank of

England or

other

central bank

rates as

commercial

banks have

reined in

lending,

fearful that

they might

not get the

cash back.

As the money

markets have

dried up,

some of the

biggest

banks in the

UK have been

deprived of

the finances

they need

for their

day to day

activities.

This has in

turn forced

the banks to

withdraw

some of

their most

generous

products and

cut back on

the amounts

that they

lend to

their

customers.

|

|

|

DUBAI

TREMBLES |

|

|

With

its kilometre high

project Dubai prides

itself on its shiny

image, something that

the city has spent the

last decade perfecting

and it is not about to

let all that hard work

go to waste, global

recession or not. So, if

anywhere can put a

positive spin on

economic meltdown, then

Dubai will have a good

go. So it was that while

the rest of the world

waited anxiously for

news on bank bailout

plans, Dubai announced

it would built the

world's tallest tower.

Dubai is anxious to

preserve its image of

opulence, whatever the

stocks say. As housing

prices were wobbling

elsewhere, the huge

annual property

exhibition reported

remaining busy and

potential investors were

encouraged by a survey

saying real estate

prices in the Middle

East will significantly

out perform all other

regions. No-one sensible

is now predicting the

continuation of the

exponential price

increases that have been

seen in Dubai since it

opened its property

market to foreigners,

but there is a belief

prices will continue to

rise more steadily - not

least because rents are

extortionate and the

increasing number of

people moving to the

city all need somewhere

to live. |

|

|

|

|

Bond's new adventure in

Quantum of Solace has

edgy close-ups of Daniel

Craig's granite features

give way to a spectacular

high-speed chase around an

Italian coastal road.

Bullets fly, glass

splinters, cars crunch, in a

scene that - like many of

the film's best - owes much

to the quick-fire editing of

the Bourne thrillers. By the

time the opening credits

come along, playing out to

Jack White and Alicia Keys's

punchy title song, you

realise you've barely

breathed for five minutes.

Thereafter, Craig's second

outing as the famous

so-called "spy" - actually,

when you think about it, an

assassin - turns out to be a

tale of revenge. And not for

the first time in the

franchise: Timothy Dalton

spent the whole of 1989's

Licence to Kill in pursuit

of the man who murdered the

wife of his CIA chum Felix

Leiter. In this much darker

film, picking up from where

Casino Royale left off, 007

finds himself after two

people: the man who fatally

betrayed Vesper Lynd, the

woman he loved; and Dominic

Greene (bullfrog-eyed

Mathieu Amalric), a big

player in the sinister

organisation that

blackmailed her, now

striking a shady deal in

some Bolivian desert. |

|

|

QUEEN LIZ VISITS GOOGLE |

|

|

|

LAID

OFF TRADERS QUIT BANK |

|

|

|

|

|

WHO'S

GOING DOWN

THE TUBE |

|

|

|

|

Andrew Lahde of Lahde Capital

Management says goodbye to suckers and flies off

into the sunset to live happily ever on his

870% capital gain |

|

|

An

extraordinary letter to the Financial Times from

Andrew Lahde of Lahde Capital Management |

October 17, 2008

Today I write not to

gloat. Given the pain that nearly

everyone is experiencing, that would be

entirely inappropriate. Nor am I writing

to make further predictions, as most of

my forecasts in previous letters have

unfolded or are in the process of

unfolding. Instead, I am writing to say

goodbye.

Recently, on the front

page of Section C of the Wall Street

Journal, a hedge fund manager who was

also closing up shop (a $300 million

fund), was quoted as saying, “What I

have learned about the hedge fund

business is that I hate it.” I could not

agree more with that statement. I was in

this game for the money. The low hanging

fruit, i.e. idiots whose parents paid

for prep school, Yale, and then the

Harvard MBA, was there for the taking.

These people who were (often) truly not

worthy of the education they received

(or supposedly received) rose to the top

of companies such as AIG, Bear Stearns

and Lehman Brothers and all levels of

our government. All of this behavior

supporting the Aristocracy only ended up

making it easier for me to find people

stupid enough to take the other side of

my trades. God bless America.

There are far too many

people for me to sincerely thank for my

success. However, I do not want to sound

like a Hollywood actor accepting an

award. The money was reward enough.

Furthermore, the endless list of those

deserving thanks know who they are.

I will no longer

manage money for other people or

institutions. I have enough of my own

wealth to manage. Some people, who think

they have arrived at a reasonable

estimate of my net worth, might be

surprised that I would call it quits

with such a small war chest. That is

fine; I am content with my rewards.

Moreover, I will let others try to amass

nine, ten or eleven figure net worths.

Meanwhile, their lives suck.

Appointments back to back, booked solid

for the next three months, they

lookforward to their two week vacation

in January during which they will likely

be glued to their Blackberries or other

such devices. What is the point? They

will all be forgotten in fifty years

anyway. Steve Balmer, Steven Cohen, and

Larry Ellison will all be forgotten. I

do not understand the legacy thing.

Nearly everyone will be forgotten. Give

up on leaving your mark. Throw the

Blackberry away and enjoy life.

So this is it. With

all due respect, I am dropping out.

Please do not expect any type of reply

to emails or voicemails within normal

time frames or at all. Andy Springer and

his company will be handling the

dissolution of the fund. And don’t worry

about my employees, they were always

employed by Mr. Springer’s company and

only one (who has been well-rewarded)

will lose his job.

I have no interest in

any deals in which anyone would like me

to participate. I truly do not have a

strong opinion about any market right

now, other than to say that things will

continue to get worse for some time,

probably years. I am content sitting on

the sidelines and waiting. After all,

sitting and waiting is how we made money

from the subprime debacle. I now have

time to repair my health, which was

destroyed by the stress I layered onto

myself over the past two years, as well

as my entire life – where I had to

compete for spaces in universities and

graduate schools, jobs and assets under

management – with those who had all the

advantages (rich parents) that I did

not. May meritocracy be part of a new

form of government, which needs to be

established.

On the issue of the

U.S. Government, I would like to make a

modest proposal. First, I point out the

obvious flaws, whereby legislation was

repeatedly brought forth to Congress

over the past eight years, which would

have reigned in the predatory lending

practices of now mostly defunct

institutions. These institutions

regularly filled the coffers of both

parties in return for voting down all of

this legislation designed to protect the

common citizen. This is an outrage, yet

no one seems to know or care about it.

Since Thomas Jefferson and Adam Smith

passed, I would argue that there has

been a dearth of worthy philosophers in

this country, at least ones focused on

improving government. Capitalism worked

for two hundred years, but times change,

and systems become corrupt. George Soros,

a man of staggering wealth, has stated

that he would like to be remembered as a

philosopher. My suggestion is that this

great man start and sponsor a forum for

great minds to come together to create a

new system of government that truly

represents the common man’s interest,

while at the same time creating rewards

great enough to attract the best and

brightest minds to serve in government

roles without having to rely on

corruption to further their interests or

lifestyles. This forum could be similar

to the one used to create the operating

system, Linux, which competes with

Microsoft’s near monopoly. I believe

there is an answer, but for now the

system is clearly broken.

Lastly, while I still

have an audience, I would like to bring

attention to an alternative food and

energy source. You won’t see it included

in BP’s, “Feel good. We are working on

sustainable solutions,” television

commercials, nor is it mentioned in

ADM’s similar commercials. But hemp has

been used for at least 5,000 years for

cloth and food, as well as just about

everything that is produced from

petroleum products. Hemp is not

marijuana and vice versa. Hemp is

the male plant and it grows like a weed,

hence the slang term. The original

American flag was made of hemp fiber and

our Constitution was printed on paper

made of hemp. It was used as recently as

World War II by the U.S. Government, and

then promptly made illegal after the war

was won. At a time when rhetoric is

flying about becoming more

self-sufficient in terms of energy, why

is it illegal to grow this plant in this

country? Ah, the female. The evil female

plant – marijuana. It gets you high, it

makes you laugh, it does not produce a

hangover. Unlike alcohol, it does not

result in bar fights or wife beating.

So, why is this innocuous plant illegal?

Is it a gateway drug? No, that would be

alcohol, which is so heavily advertised

in this country. My only conclusion as

to why it is illegal, is that Corporate

America, which owns Congress, would

rather sell you Paxil, Zoloft, Xanax and

other addictive drugs, than allow you to

grow a plant in your home without some

of the profits going into their coffers.

This policy is ludicrous. It has surely

contributed to our dependency on foreign

energy sources. Our policies have other

countries literally laughing at our

stupidity, most notably Canada, as well

as several European nations (both

Eastern and Western). You would not know

this by paying attention to U.S. media

sources though, as they tend not to

elaborate on who is laughing at the

United States this week. Please people,

let’s stop the rhetoric and start

thinking about how we can truly become

self-sufficient.

With that I say

goodbye and good luck.

All the best,

Andrew Lahde

|

|

|

|

|

Since food prices began to rise

100 million more people have been pushed into poverty,

according to the World Bank, with as many as two billion

on the verge of disaster. Almost half the world's

population, let's remember, live on less than $2.50 per

day. Millions die annually of hunger and starvation, and

more than a billion do not have access to fresh water. |

With the world financial crisis

these numbers are poised to rise dramatically with

population growth, dwindling natural resources and

higher consumer prices across all goods and services. So

as the stock market tumbles and the world economy

falters, it's important to remember that it's more than

financial losses we are talking about, it's the loss of

life. |

|

|