|

|

Until this month, few people had ever

heard of, let alone read, a novel by

aspiring Australian writer Harry

Nicolaides entitled Verisimilitude.

According to the author, it was

published three years ago, and in his

own words "pulls away the mask of benign

congeniality that Thailand has disguised

itself with for decades, and reveals a

people who are obsessed with Western

affluence and materialism". The book

sank into immediate obscurity. Only 50

copies were printed, and just seven

sold. Mr Nicolaides, 41, continued to

work in Thailand - as a lecturer in

hospitality and tourism at a university

in the northern town of Chiang Rai. There are plenty of other

foreigners making a living in much the

same way. But one passage in his

forgotten novel has come back to haunt

him. It refers briefly, and

unflatteringly, to the lifestyle of a

crown prince, presumed by the Thai

authorities to be Prince Maha

Vajiralongkorn, heir to the throne. They

have used it as the basis for a charge

of "lese-majeste" against Mr Nicolaides. A warrant for his arrest was issued

in March this year, but - such is the

habitual secrecy that surrounds all

"lese-majeste" cases - he was never

informed of this. He continued to travel in and out of

Thailand on visa runs, until 31 August,

when he was detained as he was about to

board a flight to Australia.

Today he is being held in a remand

centre in Bangkok, awaiting trial.

He was able to raise bail of 500,000

Thai baht ($15,000), but denied it on

the grounds that he might flee the

country. "I feel persecuted, to be honest," he

said. "I don't feel I belong here. I

want to be given a chance to apologise

and explain, but not be in here, and

experience these indignities and

inhumanities," Mr Nicolaides said. He said he was being held in a cell

with 90 other inmates, all of them Thai.

"Someone learned that I am here for

offending the monarch, and I had some

very icy looks from men with tattoos

from neck-to-toe," he said. The

nightmarish situation Mr Nicolaides

finds himself in is a chilling reminder

of the severity of Thailand's "lese-majeste"

law - he faces up to 15 years in jail -

and of the unpredictability of its

enforcement. |

|

|

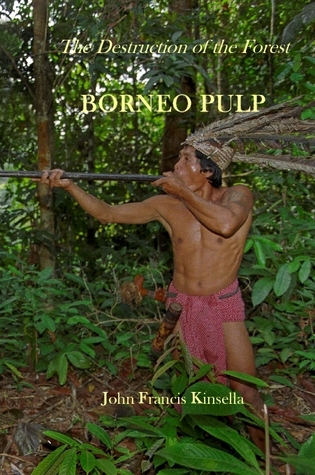

John Francis Kinsella's novel, Borneo Pulp,

tells the story of how a group of

industrialists planned the destruction

of Borneo's rain forests in their race

for profits. |

|

In the last decades of the

twentieth century the destruction of the

Indonesian rainforest accelerated with the

arrival of large multinational forestry industry

companies. The promoters are Europeans,

Indonesians and Taiwanese, backed by

international banks who vie for a share in the

rich rewards, in total disregard for the

destruction that will be wreaked on the habitat

of the indigenous peoples and the terrible

effect that the mill would have on the natural

environment. John Ennis arrives in Jakarta, on

behalf of the consortium formed to promote the

project, where he discovers an unexpectedly new

world. Assigned to head the development by

Antoine Brodzski the promoter and a Scandinavian

multinational, he is plunged into a conflict of

financial and political interests in Suharto’s

Indonesia, where dollars are more important than

the obliteration of huge swaths of Borneo’s

primary forests and its unique wildlife and

ecosystem. |

|

|

|

|

|

A BEAR MARKET IN SPITE

OF FRIDAY'S GAINS |

|

|

|

|

LEHMAN

FAILS AIG

NATIONALIZED |

|

In one

of the most

dramatic

days in Wall

Street

history,

Lehman

Brothers

said it

would file

for Chapter

11

bankruptcy,

while

Merrill

Lynch agreed

to sell

itself to

Bank of

America for

about $50

billion. As

the fates of

Lehman and

Merrill hung

in the

balance,

another

crisis

loomed as

the

insurance

giant

American

International

Group

appeared to

teeter.

Staggered by

losses

stemming

from the

credit

crisis,

A.I.G.

sought a $40

billion

lifeline

from the

Federal

Reserve,

without

which the

company may

have only

days to

survive. The

Treasury and

Federal

Reserve have

already

stepped in

on several

occasions to

rescue the

financial

system,

forcing a

shotgun

marriage

between

Bear Stearns

and

JPMorgan

Chase

this year

and

backstopping

$29 billion

worth of

troubled

assets — and

then

agreeing to

bail out

Fannie Mae

and Freddie

Mac only

this month.

For Bank of

America,

which this

year bought

Countrywide

Financial,

the troubled

mortgage

lender, the

purchase of

Merrill puts

it at the

pinnacle of

American

finance,

making it

the biggest

brokerage

house and

consumer

banking

franchise.

Concerning

the Fed,

both Mr.

Paulson and

Mr. Bernanke

were worried

that they

had already

gone much

further than

they had

ever wanted,

first by

underwriting

the takeover

of Bear

Stearns in

March and by

the far

bigger

bailout of

Fannie Mae

and Freddie

Mac. |

|

|

|

|

|

In parallel with the

demise of Lehman

Brothers came

the end of an era for

Merrill Lynch,

the brokerage firm

that brought Wall

Street to Main

Street. Merrill,

which has lost more

than $45 billion on

its mortgage

investments, agreed

to sell itself to

Bank of America

for $50.3 billion in

stock, according to

people briefed on

the negotiations.

“It is an enormous

shock,” said Steve

Fraser, a Wall

Street historian and

author of “Wall

Street: America’s

Dream Palace.”

“Merrill was a kind

of bedrock

institution whose

stability and

longevity was taken

for granted and was

reassuring to

people,” Mr. Fraser

said. “Even in these

very highly erratic

and speculative

marketplaces like

we’ve been living

through, you didn’t

think Merrill would

be vulnerable.” |

|

|

|

ENDANGERED

SPECIES AS ICE

POLAR CAP MELTS

http://www.worldwildlife.org |

|

|

|

|

|

|

AMERICAN

INTERNATIONAL

SAVED BY US

TAXPAYER |

|

|

|

|

|

|

|

|

ISLAMABAD ATTACK |

|

|

|

|

|

$500 BILLION

BAILOUT FOR WALL STREET |

|

The enormity of the financial

crisis now engulfing Wall Street has led the

Bush administration to abandon its free-market

principles and announce a $700bn bail-out

package to buy up distressed financial assets.

At the same time, to stem growing panic among

individual investors, the Treasury also plans to

offer guarantees for the $3.2 trillion in money

market mutual funds, which many people had

treated as cash. However, the US Treasury’s $700

billion (£380 billion) plan to bail out the

banks could undermine the dollar, economists

warn. The plan, details of which were unveiled

yesterday, will seek congressional approval to

raise the total amount the US government can

borrow from $10.6 trillion to $11.3 trillion. It

also gives Hank Paulson, the US Treasury

secretary, immunity from legal challenge under

the plan. The US Treasury will buy

mortgage-related securities “from any financial

institution having its headquarters in the

United States”, draft legislation said.

Securities issued before September 17 will be

eligible for inclusion. Word of the proposals

created a mood of euphoria in financial markets

on Friday. But analysts warned of the risks. |

|

|