Britain's Bradford &

Bingley to become latest victim

|

|

|

B&B, the eighth

largest mortgage lender, is the latest

banking institution to become a victim

of the financial crisis and the

deteriorating state of the housing

market. Its shares fell six per cent to

an all-time low of 20p as it became

clear that no rival bank was prepared to

mount a rescue bid. Since the start of

the year, B&B shares have fallen 90 per

cent. However, the British Banking

Association reassured the 2.5 million

customers who have £22 billion deposited

with B&B. "Customers have no need to

worry about any deposits in any British

bank. "The Financial Services

Compensation Scheme covers all savings

up to £35,000, which... covers 96 per

cent of all banking customers." Treasury

officials intervened in an attempt to

find a private-sector solution. However,

banking sources said that with no

private buyer coming forward, B&B would

have to be nationalised, resulting in a

possible merger with Northern Rock. A

B&B spokesman said: "We are fully-funded

and we are one of the strongest

capitalised banks in the UK. "As far as

the febrile speculation goes, we do not

comment on market rumours." The bank

said it is in no immediate danger

because it has funding in place until

2009. But it has effectively closed for

new mortgage business after cutting 300

jobs in its mortgage centre on Thursday.

If B&B were to fail, it would join a

growing list of major financial

institutions around the world that have

been swept up in the economic turmoil.

Financial specialists warn that if

Congress fails to agree on a proposed

$700 billion bail-out package for the US

economy the list will grow. |

|

|

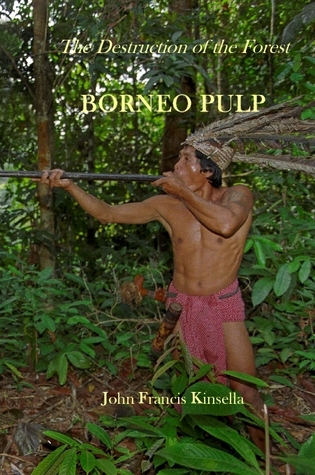

John Francis Kinsella's novel, Borneo Pulp,

tells the story of how a group of

industrialists planned the destruction

of Borneo's rain forests in their race

for profits. |

|

In the last decades of the

twentieth century the destruction of the

Indonesian rainforest accelerated with the

arrival of large multinational forestry industry

companies. The promoters are Europeans,

Indonesians and Taiwanese, backed by

international banks who vie for a share in the

rich rewards, in total disregard for the

destruction that will be wreaked on the habitat

of the indigenous peoples and the terrible

effect that the mill would have on the natural

environment. John Ennis arrives in Jakarta, on

behalf of the consortium formed to promote the

project, where he discovers an unexpectedly new

world. Assigned to head the development by

Antoine Brodzski the promoter and a Scandinavian

multinational, he is plunged into a conflict of

financial and political interests in Suharto’s

Indonesia, where dollars are more important than

the obliteration of huge swaths of Borneo’s

primary forests and its unique wildlife and

ecosystem. |

|

|

|

|

|

RUN ON HONG KONG BANK

OF EAST ASIA |

|

Symptomatic

of the financial

crisis sweeping

the world

Hong Kong's

central bank

sought to defuse

a run of the

Bank of East

Asia by

injecting an

estimated

HK$3.9bn ($500m,

£269m) to the

territory's

banking system.

The government

has also

repeated the

Bank of East

Asia's

assurances that

it is sound and

that depositors

have nothing to

fear. On

Wednesday,

rumours that the

bank was

vulnerable

spurred

thousands of

people to

withdraw their

money.

On Thursday, the queues at bank branches were much smaller and

before midday

local time, the

stock market had

recovered most

of what it had

lost the day

before. |

|

|

|

|

LEHMAN

FAILS AIG

NATIONALIZED |

|

In one

of the most

dramatic

days in Wall

Street

history,

Lehman

Brothers

said it

would file

for Chapter

11

bankruptcy,

while

Merrill

Lynch agreed

to sell

itself to

Bank of

America for

about $50

billion. As

the fates of

Lehman and

Merrill hung

in the

balance,

another

crisis

loomed as

the

insurance

giant

American

International

Group

appeared to

teeter.

Staggered by

losses

stemming

from the

credit

crisis,

A.I.G.

sought a $40

billion

lifeline

from the

Federal

Reserve,

without

which the

company may

have only

days to

survive. The

Treasury and

Federal

Reserve have

already

stepped in

on several

occasions to

rescue the

financial

system,

forcing a

shotgun

marriage

between

Bear Stearns

and

JPMorgan

Chase

this year

and

backstopping

$29 billion

worth of

troubled

assets — and

then

agreeing to

bail out

Fannie Mae

and Freddie

Mac only

this month.

For Bank of

America,

which this

year bought

Countrywide

Financial,

the troubled

mortgage

lender, the

purchase of

Merrill puts

it at the

pinnacle of

American

finance,

making it

the biggest

brokerage

house and

consumer

banking

franchise.

Concerning

the Fed,

both Mr.

Paulson and

Mr. Bernanke

were worried

that they

had already

gone much

further than

they had

ever wanted,

first by

underwriting

the takeover

of Bear

Stearns in

March and by

the far

bigger

bailout of

Fannie Mae

and Freddie

Mac. |

|

|

BUSH LOOKS AT TRUTH

HEAD-ON |

|

|

American lawmakers

inched closer to a deal

on a $700bn bail-out of

America's teetering

banking industry last

night after a day of

political wrangling

complicated by the

involvement of

presidential rivals John

McCain and Barack Obama.

Congressional leaders

pledged they would work

through the weekend to

find common ground,

after Republicans defied

their president by

walking away from an

initial agreement,

fearing a voter backlash

over the cost of

rescuing Wall Street

banks. McCain had

threatened on Wednesday

to boycott the first

presidential debate with

Obama in Oxford,

Mississippi, last night,

but backed off at midday

yesterday. He flew from

Washington to Oxford for

the debate, as did Obama.

Both presidential

candidates are scheduled

to return to Washington

afterward. A rescue deal

is unlikely until they

return, with both

parties keen to have

their presidential

candidates take credit -

even if their roles were

peripheral. Last night,

Gordon Brown said he was

backing the bail-out

after talks with Bush at

the White House. Bush

said: "The prime

minister wants to know

if the plan is big

enough to make a

difference, and if it is

going to be passed, I

told him it is big

enough to make a

difference, and it is

going to be passed." |

|

|

|

|

Government

Seizes WaMu in the biggest

bank failure in history,

JPMorgan Chase will acquire

massive branch network and

troubled assets from

Washington Mutual for $1.9

billion. Washington Mutual,

the giant lender that came

to symbolize the excesses of

the mortgage boom, was

seized by federal regulators

on Thursday night, in what

is by far the largest bank

failure in American history.

Regulators simultaneously

brokered an emergency sale

of virtually all of

Washington Mutual, the

nation’s largest savings and

loan, to JPMorgan Chase for

$1.9 billion, averting

another potentially huge

taxpayer bill for the rescue

of a failing institution.

The move came as lawmakers

reached a stalemate over the

passage of a $700 billion

bailout fund designed to

help ailing banks, and

removed one of America’s

most troubled banks from the

financial landscape.

Customers of WaMu, based in

Seattle, are unlikely to be

affected, although

shareholders and some

bondholders will be wiped

out. WaMu account holders

are guaranteed by the

Federal Deposit Insurance

Corporation up to $100,000,

and additional deposits will

be backed by JPMorgan Chase.

By taking on all of WaMu’s

troubled mortgages and

credit card loans, JPMorgan

Chase will absorb at least

$31 billion in losses that

would normally have fallen

to the F.D.I.C. JPMorgan

Chase, which acquired Bear

Stearns only six months ago

in another shotgun deal

brokered by the government,

is to take control Friday of

all of WaMu’s deposits and

bank branches, creating a

nationwide retail franchise

that rivals only Bank of

America. But JPMorgan will

also take on Washington

Mutual’s big portfolio of

troubled assets, and plans

to shut down at least 10

percent of the combined

company’s 5,400 branches in

markets like New York and

Chicago, where they compete.

The bank also plans to raise

an additional $8 billion by

issuing common stock on

Friday to pay for the deal. |

|

|

|

|

|

|

Financial

Crisis: US

will lose

superpower

status |

|

German

minister German finance

minister Peer

Steinbrück has

slammed

Anglo-American

capitalism for

endangering global

stability in its

lust for profit and

predicted that the

US would now be

toppled as the

superpower of

international

finance. Senior

politicians in

France and Germany

have in recent weeks

called for a radical

shake-up of the

market system. A

powerful EU faction

that has always been

hostile to the City

of London – which is

known in Brussels as

“the casino” – see

this crisis as a

rare chance to ram

through irreversible

changes.

|

|

|

|

|

|

|

$500 BILLION

BAILOUT FOR WALL STREET |

|

The enormity of the financial

crisis now engulfing Wall Street has led the

Bush administration to abandon its free-market

principles and announce a $700bn bail-out

package to buy up distressed financial assets.

At the same time, to stem growing panic among

individual investors, the Treasury also plans to

offer guarantees for the $3.2 trillion in money

market mutual funds, which many people had

treated as cash. However, the US Treasury’s $700

billion (£380 billion) plan to bail out the

banks could undermine the dollar, economists

warn. The plan, details of which were unveiled

yesterday, will seek congressional approval to

raise the total amount the US government can

borrow from $10.6 trillion to $11.3 trillion. It

also gives Hank Paulson, the US Treasury

secretary, immunity from legal challenge under

the plan. The US Treasury will buy

mortgage-related securities “from any financial

institution having its headquarters in the

United States”, draft legislation said.

Securities issued before September 17 will be

eligible for inclusion. Word of the proposals

created a mood of euphoria in financial markets

on Friday. But analysts warned of the risks. |

|

|