|

|

|

An independent view of the world

seen from Tokelau

The Independent New York Times

Tokelau, Saturday,

November 22,

2008 Weekend Edition, editor

- contact sumpinein@gmail.com

|

|

|

|

|

|

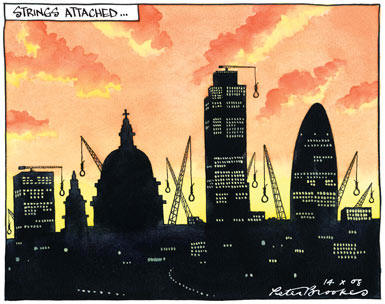

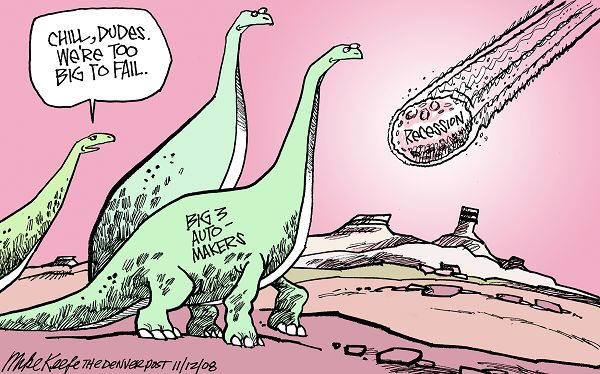

IN SPITE OF

DOW RALLY IS THIS THE

BEGINNING OF A GREAT DEPRESSION? |

It's a minority but

growing view, including from 86-year old

former Goldman Sachs chairman, John

Whitehead, at the November 12 Reuters

Global Finance Summit in New York. As

disturbing evidence mounts, he said: "I

think it would be worse than the

depression. We're talking about reducing

the credit of the United States of

America, which is the backbone of the

economic system. I see nothing but large

increases in the deficit, all of which

are serving to decrease the credit

standing of America.

|

|

|

Conservationists are excited about the

arrival, which is the first birth of a

pygmy hippo at Taronga zoo in Sydney,

Australia, in 23 years. |

|

|

|

A UN study says that in financial

terms currently the loss of forest

equals some US$2 to US$5 trillion every

year. Who is going to do something about

all this? Indonesian authorities

have pledged to stop the loss of forests

and species in Sumatra, one of the

world's most ecologically important

islands. Representatives of the island's

10 provinces, national government and

the environment group WWF launched the

deal at the World Conservation Congress.

Sumatra has lost about half of its

forest cover in the last 20 years. It is

home to a number of important and iconic

species such as the tiger, orangutan,

rhinoceros and elephant. The island has

suffered floods and forest fires in

recent years that have been widely

attributed to illegal forest clearance.

Two years ago, President Susilo Bambang

Yudhoyono was forced to apologise to

Singapore and Malaysia when smog from

burning Sumatran forest covered the

neighbouring countries. The need to deal

with these issues appears to have played

a big part in persuading the authorities

to act. "In the rainy months, we are

seeing landslides and flooding more

often, and it is time to make a real

change," said Indonesia's deputy

environment minister Hermien Roosita at

a news briefing here. "Every governor

from the 10 provinces and four

(national) ministries have signed this

monumental commitment to ecosystem

restoration of the island and protecting

the remaining natural forest." More than

13% of the island's forests lie on peat,

which contain vast amounts of carbon

that would be lost to the atmosphere if

the trees were removed, accelerating

climate change. "When you look at the

flora and fauna in this area and the

rate of loss that's going on, this is a

substantial commitment to protect and

restore forests," said Gordon Shepherd,

WWF's director of global policy. The

government has already regulated to stop

clearance of virgin forest for palm oil

plantations - grown for food, industry

and biofuels - but the government

acknowledges the ban may not be

completely effective. |

|

|

Read DEATH OF A

FINANCIER by JOHN

FRANCIS KINSELLA |

|

Tom Barton, a City

mortgage broker, decides

to quit his business in

the wake of the subprime

crisis and arrives in

Kovalam, in the south of

India. In the Maharaja

Palace he finds himself

in the company of

holiday makers from the

UK, Scandinavia and

Russia. Stephen Parkly,

the CEO of a successful

City bank, and his young

wife Emma are taking a

well earned year end

break. Parkly falls

gravely ill with a

mysterious infection,

whilst back in the City,

unknown to him his

mortgage and investment

bank, West Mercian

Finance is in grave

difficulties. Ryan

Kavanagh, a doctor,

comes to Emma’s aid with

the help of Barton,

after an attempted

cover-up by the Indian

authorities, who fear

for their tourist

industry and more

especially medical

tourism, as the disease

threatens the resort

with the tourist season

in full swing. Thousands

of British tourists

enjoying the sun are

unaware of the pending

disaster, many are

equally unaware their

savings about are to be

wiped out in the West

Mercian collapse. |

|

OR PRINT

VERSION

FROM

| More books by John Francis Kinsella from Vincennes Books: Borneo Pulp, The Legacy of Solomon, Offshore Islands, The Lost Forest |

|

|

|

|

|

|

THE WORLD AS IT

IS...WAS? - A CASINO |

|

Peter Eastgate

of Denmark

celebrates after

winning $9.15

million during

the World Series

of Poker at the

Rio Hotel and

Casino in Las

Vegas, Nevada.

Eastgate, 22,

defeated Ivan

Demidov of

Russia to become

the youngest

champion of the

World Series of

Poker main

event. |

|

|

|

|

TOUGH

TIMES FOR OPEC WITH LOW

PRICES |

|

|

Opec members

have lost

about $700bn

(£467bn)

because of

falling

crude

prices, the

oil cartel's

president

Chakib

Khelil said

in an

interview.

Oil prices

have fallen

60% from

their $147

peak,

prompting

speculation

Opec will

cut output

again to

boost

prices. However,

speaking to

Algerian

newspaper El Khabar, Mr

Khelil said

Opec was

unlikely to

make a

decision

this month.

He said the

following

meeting on

17 December

would be

"the most

important"

as the

cartel would

get

necessary

data.

The data

will show

whether

Opec's

previous

output cuts

have been

applied by

its members.

The cartel,

which

controls 40%

of the

world's oil

supply,

agreed on a

1.5 million

barrel-a-day

reduction

last month.

On

Wednesday,

US light,

sweet crude

stood at

$54.47 a

barrel,

while Brent

crude cost

$51.84 a

barrel.

"The Cairo

meeting [on

29 November]

is

considered

as an

internal

debate,

while the

meeting

scheduled in

Oran [on 17

December],

will be more

important in

a sense that

we will

obtain, by

that time,

more

information

about the

oil market

trend," El

Khabar

quoted Mr

Khelil as

saying.

"All

members...

are very

concerned

about the

economic

situation

which has

worsened in

the United

States and

Europe who

have entered

into a

recession,

followed by

Japan," the

Opec

president

said. |

|

|

G20? G TOO MANY |

|

Vincent Cable

wrote that by

the low

standards of

economic

summitry, the

G20 meeting

rated quite

high. There was

a predictable,

no doubt

pre-written,

communiqué, full

of the usual

banalities. And

the meeting

suffered from

the absence of

the world's most

important

politician, who

hasn't yet taken

up office. But,

these necessary

caveats aside,

there were

important

achievements.

The first is

that the meeting

took place at

all. The

ludicrous

pretence of the

G8 (or G7) that

the old western

powers should

set the global

economic agenda

has been

punctured for

good. On a

purchasing power

parity basis,

China has the

second-biggest

economy in the

world and India

the fourth. It

has been clear

for some time

that China is

lender of last

resort to the

global system

(by, in effect,

underwriting US

government

paper) and the

main source of

global

incremental

demand (and

commodity price

inflation). The

Chinese

self-parody as

the pupil

sitting meekly

at the feet of a

dominant, but

erring, master

defies belief.

It is obviously

right that

China, India and

the other main

non-G7 countries

should be at the

top table. The

second

achievement was

the clear

realisation that

unless

governments hang

together they

will hang

separately.

Enough has been

learned from

interwar history

for us to

understand the

follies of

beggar-my-neighbour

economics.

Perhaps a

warning shock

was being sent

across the bows

of the incoming

Obama

administration

not to reinvent

the

protectionist

tariffs of the

1930s in a new

guise, directed

at China or

Mexico in

particular, or

aiming to

salvage the US

auto industry

through public

subsidy. But

this new-found

concern for open

markets has not

yet communicated

itself to EU or

Indian or

Chinese trade

negotiators, who

show no

enthusiasm for

lifting the

block on trade

liberalisation

under the Doha

round. While

trade policy is

on the back

burner,

macroeconomic

policy

co-ordination is

not. With a few

exceptions -

Germany notably

- there is

recognition of

the need for

aggressive

monetary and

fiscal policy

and for

large-scale

intervention to

recapitalise

banks. These

interventions

can be and are

being undertaken

nationally. But

governments

acting in

isolation

attract critical

attention from

capital markets

and currency

speculators, as

Gordon Brown is

discovering.

Structures like

the G20 are the

best safeguard

against chaotic,

unilateral

action. |

|

|

Anxiety Rises for US

Farmers as Crop Prices

Fall |

|

|

|

|

|

LONDON (Reuters) - Oil dived

under $50 a barrel on

Thursday to hit the lowest

level since May 2005,

deepening losses as

financial markets reflected

ever lower confidence in the

world economy and evidence

mounted of falling fuel

demand. U.S. crude fell $3.26 to

$50.36 a barrel by 3:36 p.m.

after earlier touching

$49.75, marking the lowest

level since May 25, 2005,

when prices hit $49.58. London Brent crude shed

$2.82 to $48.90 a barrel. As economic slowdown has

destroyed fuel demand, oil

companies plan to store

millions of barrels of oil

in the hope economics will

improve. The number of U.S.

workers filing new claims

for jobless benefits rose by

a larger than expected

27,000 last week to their

highest level in 16 years,

Labour Department data

showed on Thursday. "The unemployment data

was yet another ugly data

point in a seemingly never

ending stream of poor

economic numbers," said

Michael Wittner, global head

of oil research at Societe

Generale. "What makes it hard to

call a bottom is that even

when oil fundamentals firm

up, if we're still having

these waves of deleveraging

it can overwhelm even the

oil fundamentals." |

|

|

CLOUDS OVER GULF |

|

Is the fun over? Saudi Arabia

and Dubai are now down by around

50% this year, Kuwait down 20%

and the MSCI index tracking the

Gulf's key markets has lost 43%.

Last week, Kuwait became the

third Gulf state to prop up its

banking system, guaranteeing

deposits after bailing out the

country's fifth-biggest lender,

Gulf Bank, whose corporate

clients had defaulted on

currency bets. The United Arab

Emirates, of which Dubai is the

second-largest member, has

guaranteed local bank accounts

for three years and made $33bn

available to the banking system

amid a squeeze in local money

markets. Saudi Arabia has put

$5bn into commercial banks and

set aside $2.7bn for no-fee

loans to low-income citizens.

Central banks across the region

have also cut benchmark interest

rates. The main worry now is the

real-estate market, where credit

conditions are tightening – HSBC

will now only lend up to 70% of

the value of a property, down

from 85% – and the property boom

is rapidly cooling. Cairo-based

EFG-Hermes reckons property

values could slide by 20% in the

next three years. "I see the

risk of a real-estate bust

throughout the Gulf" amid

sliding oil prices and a

liquidity and credit crunch,

says Nouriel Roubini of New York

University. And "there's a huge

amount of excess capacity being

built": Dubai and Saudi

billionaire Prince Alwaleed are

currently racing to build the

world's first kilometre-tall

tower. Dubai can tap another

emirate, Abu Dhabi, for cash,

while the region as a whole

boasts a projected $150bn in

budget surpluses for 2008. The

IMF thinks most Gulf states

should be able to balance their

budgets unless oil slides below

$30 a barrel, says Andrew

Crichlow on WSJ.com. With large

current-account surpluses and

relatively low external

financing needs, the region

looks more resilient than other

emerging markets, says Merrill

Lynch, which has lowered its

regional 2009 GDP forecast to

4.5% from 6.2%. But while the

Gulf may not fall victim to an

emerging-market crisis, the

notion that it is a safe haven

from global turmoil has been

well and truly shattered. |

|

|

|

The

map shows hectares' worth consumed in goods and

services |

|

|

The planet is headed for an

ecological "credit crunch", according to

a report issued by conservation groups.

The document contends that our demands

on natural resources overreach what the

Earth can sustain by almost a third. The

Living Planet Report is the work of WWF,

the Zoological Society of London and the

Global Footprint Network. It says that

more than three quarters of the world's

population lives in countries where

consumption levels are outstripping

environmental renewal.

This makes them "ecological debtors", meaning that they are drawing

- and often overdrawing - on the

agricultural land, forests, seas and

resources of other countries to sustain

them. The report concludes that the

reckless consumption of "natural

capital" is endangering the world's

future prosperity, with clear economic

impacts including high costs for food,

water and energy. "If our demands on the

planet continue to increase at the same

rate, by the mid-2030s we would need the

equivalent of two planets to maintain

our lifestyles," said WWF International

director-general James Leape. Dr Dan

Barlow, head of policy at the

conservation group's Scotland arm,

added: "While the media headlines

continue to be dominated by the economic

turmoil, the world is hurtling further

into an ecological credit crunch." The

countries with the biggest impact on the

planet are the US and China, together

accounting for some 40% of the global

footprint. The report shows the US and

United Arab Emirates have the largest

ecological footprint per person, while

Malawi and Afghanistan have the

smallest. "The events in the last few

months have served to show us how it's

foolish in the extreme to live beyond

our means," said WWF's international

president, Chief Emeka Anyaoku.

"Devastating though the financial credit

crunch has been, it's nothing as

compared to the ecological recession

that we are facing." He said the more

than $2 trillion (£1.2 trillion) lost on

stocks and shares was dwarfed by the up

to $4.5 trillion worth of resources

destroyed forever each year. The

report's Living Planet Index, which is

an attempt to measure the health of

worldwide biodiversity, showed an

average decline of about 30% from 1970

to 2005 in 3,309 populations of 1,235

species. An index for the tropics shows

an average 51% decline over the same

period in 1,333 populations of 585

species. |

|

|

|

|

|

YES, IT'S ONLY ONE

MONTH TO CHRISTMAS |

|

Sales fall

in stores across

the world as

Christmas

approaches and

the crisis

starts to bite

and incomes fall

and unemployment

fears start to

make inroads

with families

cutting back on

spending. This

year is

beginning to

look like it

will be the

worse for

business for a

decade as the

Christmas season

approaches. |

|

|

|

Credit crunch

hits the art

market |

|

The global

financial

meltdown has

struck the art

market, with a

Francis Bacon

self-portrait

with an estimate

of $40m failing

to sell at a

disappointing

auction in New

York last night.

Almost a third

of 75

contemporary

artworks that

went under the

hammer at

Christie's in

Rockefeller

Plaza did not

find buyers at

last night's

contemporary art

auction. Among

the rejects was

Bacon's Study

for

Self-Portrait,

which was billed

as the highlight

of the sale and

which Christie's

had estimated

would sell for

around $40m

(£27m). |

|

|

|

|

|

People lined up for food last

week at one of the distribution outlets

supported by the San Francisco Food Bank. The

food bank's managers fret that they won't be

able to keep up with demand despite improved

fund raising. |

|

350,000

JOBS TO GO IN BANK & FINANCIAL COLLAPSE

- READ 'DEATH OF A FINANCIER' |

|

|

|

SPARE A

THOUGHT FOR THE YACHT OWNERS HIT BY CRISIS |

|

They were the ultimate status symbol of

the boom years, coveted by billionaire

businessmen who wanted to show off their

wealth, but the value of superyachts is

plummeting as the credit crunch really

begins to bite. Many owners are being

forced to sell their boats as their

other assets fall, and dealers are

slashing prices as the market slows.

Some bargains are on offer, according to

dealers, including the 164ft Alibella,

which boasts a helipad and marble

fixtures and fittings finished with gold

trim, and is now available for just

€24.5m (£21m) - an huge €9.5m discount -

if a buyer can come up with the cash

within a month.

Edmiston, a London-based yacht

brokers, says it was delivered to its

anonymous owner six months ago, but they

are now seeking a quick sale. An email

sent to clients by William Christie, a

broker at the company said: "The owner

will sell at this massively reduced

price if the deal can be completed

within 30 days." The Alibella can

accommodate 14 guests in six cabins, but

cheaper second-hand yachts are also

available. The 163ft Thunder B, which

has a seven-metre swimming pool, is now

available for €13.7m, down from €18.9m

and the asking price on the 146ft

Candyscape has also been slashed,

from €15.5m to €12.9m. The interior of

the boat was designed by Candy & Candy,

the upmarket property developer owned by

brothers Nick and Christian Candy, and

boasts a saloon with a giant

entertainment system, including a pop-up

flat-screen television. The 150ft

Midlandia, meanwhile, has been reduced

in price from €27m to €19.9m. It comes

with bullet-proof glass and an outdoor

cinema; perfect for a security-conscious

film buff with a few millions to spare. |

|

|

|

|

|

Since food prices began to rise

100 million more people have been pushed into poverty,

according to the World Bank, with as many as two billion

on the verge of disaster. Almost half the world's

population, let's remember, live on less than $2.50 per

day. Millions die annually of hunger and starvation, and

more than a billion do not have access to fresh water. |

With the world financial crisis

these numbers are poised to rise dramatically with

population growth, dwindling natural resources and

higher consumer prices across all goods and services. So

as the stock market tumbles and the world economy

falters, it's important to remember that it's more than

financial losses we are talking about, it's the loss of

life. |

|

|