|

|

|

An independent view of the world

seen from Tokelau

The Independent New York Times

Tokelau, Saturday,

November 15,

2008 Weekend Edition, editor

- contact sumpinein@gmail.com

|

|

|

|

|

|

US AUTOMAKERS

SEEK BAIL OUT TO AVOID BANKRUPTCY |

|

|

Conservationists are excited about the

arrival, which is the first birth of a

pygmy hippo at Taronga zoo in Sydney,

Australia, in 23 years. |

|

|

|

A UN study says that in financial

terms currently the loss of forest

equals some US$2 to US$5 trillion every

year. Who is going to do something about

all this? Indonesian authorities

have pledged to stop the loss of forests

and species in Sumatra, one of the

world's most ecologically important

islands. Representatives of the island's

10 provinces, national government and

the environment group WWF launched the

deal at the World Conservation Congress.

Sumatra has lost about half of its

forest cover in the last 20 years. It is

home to a number of important and iconic

species such as the tiger, orangutan,

rhinoceros and elephant. The island has

suffered floods and forest fires in

recent years that have been widely

attributed to illegal forest clearance.

Two years ago, President Susilo Bambang

Yudhoyono was forced to apologise to

Singapore and Malaysia when smog from

burning Sumatran forest covered the

neighbouring countries. The need to deal

with these issues appears to have played

a big part in persuading the authorities

to act. "In the rainy months, we are

seeing landslides and flooding more

often, and it is time to make a real

change," said Indonesia's deputy

environment minister Hermien Roosita at

a news briefing here. "Every governor

from the 10 provinces and four

(national) ministries have signed this

monumental commitment to ecosystem

restoration of the island and protecting

the remaining natural forest." More than

13% of the island's forests lie on peat,

which contain vast amounts of carbon

that would be lost to the atmosphere if

the trees were removed, accelerating

climate change. "When you look at the

flora and fauna in this area and the

rate of loss that's going on, this is a

substantial commitment to protect and

restore forests," said Gordon Shepherd,

WWF's director of global policy. The

government has already regulated to stop

clearance of virgin forest for palm oil

plantations - grown for food, industry

and biofuels - but the government

acknowledges the ban may not be

completely effective. |

|

|

Read DEATH OF A

FINANCIER by JOHN

FRANCIS KINSELLA |

|

Tom Barton, a City

mortgage broker, decides

to quit his business in

the wake of the subprime

crisis and arrives in

Kovalam, in the south of

India. In the Maharaja

Palace he finds himself

in the company of

holiday makers from the

UK, Scandinavia and

Russia. Stephen Parkly,

the CEO of a successful

City bank, and his young

wife Emma are taking a

well earned year end

break. Parkly falls

gravely ill with a

mysterious infection,

whilst back in the City,

unknown to him his

mortgage and investment

bank, West Mercian

Finance is in grave

difficulties. Ryan

Kavanagh, a doctor,

comes to Emma’s aid with

the help of Barton,

after an attempted

cover-up by the Indian

authorities, who fear

for their tourist

industry and more

especially medical

tourism, as the disease

threatens the resort

with the tourist season

in full swing. Thousands

of British tourists

enjoying the sun are

unaware of the pending

disaster, many are

equally unaware their

savings about are to be

wiped out in the West

Mercian collapse. |

|

|

|

|

GETTING READY FOR A

NEW LIFE |

|

Life for the

newly chosen

president and

his family has

changed forever.

Even the

constraints and

security of the

campaign trail

do not compare

to the bubble

that has

enveloped him in

the 10 days

since his

election.

Renegade, as the

Secret Service

calls him, now

lives within the

strict limits

that come with

the most

powerful office

on the planet.

He has chosen to

spend this

interval before

his Jan. 20

inauguration at

his home in Hyde

Park, which has

in some ways

been transformed

into a secure

fortress for his

protection.

After two years

of daily

speeches and

rallies, he has

retreated into

an almost hermitlike

seclusion,

largely hidden

from public view

and spotted only

when he drops

his two

daughters off

for school or

goes for a

workout at the

gymnasium in a

friend’s

apartment

building. |

|

|

|

|

Indonesian

security

forces

are on high

alert after

the state

execution of

three

Islamic

militants

for the 2002

Bali

bombings

that killed

202 people.

There were

reports of

clashes as

hundreds of

supporters

attended

burials in

the men's

home

villages in

Java. Imam

Samudra,

Amrozi

Nurhasyim

and Ali

Ghufron (Mukhlas)

were killed

by firing

squad at

0015 (1715

GMT on

Saturday).

They were

found guilty

of planning

twin attacks

on

nightclubs

at the

resort of

Kuta,

popular with

Western

tourists.

Security

forces are

on alert

across the

country amid

fears of

reprisal

attacks.

Australia,

which lost

88 of its

citizens in

the attacks,

has issued a

warning

against

travel to

the country.

Britain and

the US have

done

likewise.

|

|

|

DUBAI - NO SEX PLEASE |

|

|

One of Dubai’s most

popular beach hotels has

issued guests with an

“etiquette guide” after

two Britons were

convicted for having sex

on the beach near the

hotel. The etiquette

guides, which suggest

the hotel’s guests could

be arrested for

inappropriate public

displays, are left on

tables during the weekly

brunch event at the

Madinat Jumeirah hotel.

The guests should

"employ discretion" in

expressing affection

publicly, says the

hotel, with "anything

more than a peck on the

cheek" likely to result

in police involvement.

The two Britons

convicted last month

of having sexual

intercourse outside

marriage and offending

public decency, were

Michelle Palmer and

Vince Acors. They were

arrested after attending

brunch at a hotel near

Dubai airport. They were

received three-month

jail sentences, were

fined £200 for

drunkenness and ordered

to be deported from

Dubai on their release.

More than 230 other

Britons were arrested in

the UAE last year.

Brunches take place

across Dubai every

Friday, the first day of

the Dubai weekend, and

are heavily promoted in

Dubai's Time Out

and enjoyed to the full

by expatriates. The

lavish affairs last from

late morning into the

early evening when

diners can enjoy

unlimited food and

alcohol for a fixed

entry fee. In the case

of the

Madinat Jumeirah the

charge is £88, which

includes bottomless

champagne, cocktails and

wine between 12:30pm and

4:30pm. On the subject

of drunkenness, the

hotel’s etiquette guide

warns: “Drinking is not

a part of Muslim culture

and alcohol is not

served openly. Drunken

behaviour, especially

outside licensed

premises in the hotel,

is severely punished.”

On the subject of public

displays off affection

it says: “It is strongly

recommended that you

employ discretion when

expressing affection in

public. Anything more

than a peck on the cheek

could offend those

around you and even

possibly lead to police

involvement.” More than

one million Britons

visited Dubai last year,

with twice as many

expatriates now living

in the Emirate. The

Madinah Jumeirah is one

of Dubai's biggest and

most popular beach

hotels, next to the

iconic seven-star Burj

Al-Arab. More Britons

visit than any other

nationality - the hotel

has 584 rooms in total,

split between the Mina

A'Salam and Al Qasr

brands. A spokeswoman

for the hotel told Times

Online: "Following the

recent media attention

surrounding etiquette in

the Emirate, we have

received additional

enquiries from our

guests. As a result, we

have taken the

initiative to produce

information cards to

inform our guests about

local culture and

customs here in Dubai.

“These cards are

distributed throughout

and advise our guests

about driving around the

Emirate, acceptable

dress codes, public

displays of affection,

drinking and other

responsible and

respectful behaviour.”

|

|

|

|

|

20 people died in

an incident involving the

failure of a fire

extinguishing system on a

Russian nuclear submarine,

local media report.

Russian Pacific Fleet

spokesman Igor Dygalo said

both sailors and shipyard

workers died in the

incident, which occurred

during sea trials. He said

the submarine itself had not

been damaged and there had

been no radiation leaks.

Military prosecutors are

investigating the incident.

The submarine, whose name

and class have not been

officially revealed, has

been ordered to suspend sea

trials and return to port in

the far eastern Primorskiy

territory, Capt Dygalo said.

"I declare with full

responsibility that the

reactor compartment on the

nuclear-powered submarine is

working normally and the

radiation background is

normal," he said, quoted by

Itar-Tass news agency.

|

|

|

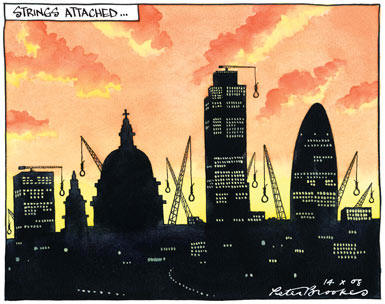

CLOUDS OVER GULF |

|

Is the fun over? Saudi Arabia

and Dubai are now down by around

50% this year, Kuwait down 20%

and the MSCI index tracking the

Gulf's key markets has lost 43%.

Last week, Kuwait became the

third Gulf state to prop up its

banking system, guaranteeing

deposits after bailing out the

country's fifth-biggest lender,

Gulf Bank, whose corporate

clients had defaulted on

currency bets. The United Arab

Emirates, of which Dubai is the

second-largest member, has

guaranteed local bank accounts

for three years and made $33bn

available to the banking system

amid a squeeze in local money

markets. Saudi Arabia has put

$5bn into commercial banks and

set aside $2.7bn for no-fee

loans to low-income citizens.

Central banks across the region

have also cut benchmark interest

rates. The main worry now is the

real-estate market, where credit

conditions are tightening – HSBC

will now only lend up to 70% of

the value of a property, down

from 85% – and the property boom

is rapidly cooling. Cairo-based

EFG-Hermes reckons property

values could slide by 20% in the

next three years. "I see the

risk of a real-estate bust

throughout the Gulf" amid

sliding oil prices and a

liquidity and credit crunch,

says Nouriel Roubini of New York

University. And "there's a huge

amount of excess capacity being

built": Dubai and Saudi

billionaire Prince Alwaleed are

currently racing to build the

world's first kilometre-tall

tower. Dubai can tap another

emirate, Abu Dhabi, for cash,

while the region as a whole

boasts a projected $150bn in

budget surpluses for 2008. The

IMF thinks most Gulf states

should be able to balance their

budgets unless oil slides below

$30 a barrel, says Andrew

Crichlow on WSJ.com. With large

current-account surpluses and

relatively low external

financing needs, the region

looks more resilient than other

emerging markets, says Merrill

Lynch, which has lowered its

regional 2009 GDP forecast to

4.5% from 6.2%. But while the

Gulf may not fall victim to an

emerging-market crisis, the

notion that it is a safe haven

from global turmoil has been

well and truly shattered. |

|

|

|

The

map shows hectares' worth consumed in goods and

services |

|

|

The planet is headed for an

ecological "credit crunch", according to

a report issued by conservation groups.

The document contends that our demands

on natural resources overreach what the

Earth can sustain by almost a third. The

Living Planet Report is the work of WWF,

the Zoological Society of London and the

Global Footprint Network. It says that

more than three quarters of the world's

population lives in countries where

consumption levels are outstripping

environmental renewal.

This makes them "ecological debtors", meaning that they are drawing

- and often overdrawing - on the

agricultural land, forests, seas and

resources of other countries to sustain

them. The report concludes that the

reckless consumption of "natural

capital" is endangering the world's

future prosperity, with clear economic

impacts including high costs for food,

water and energy. "If our demands on the

planet continue to increase at the same

rate, by the mid-2030s we would need the

equivalent of two planets to maintain

our lifestyles," said WWF International

director-general James Leape. Dr Dan

Barlow, head of policy at the

conservation group's Scotland arm,

added: "While the media headlines

continue to be dominated by the economic

turmoil, the world is hurtling further

into an ecological credit crunch." The

countries with the biggest impact on the

planet are the US and China, together

accounting for some 40% of the global

footprint. The report shows the US and

United Arab Emirates have the largest

ecological footprint per person, while

Malawi and Afghanistan have the

smallest. "The events in the last few

months have served to show us how it's

foolish in the extreme to live beyond

our means," said WWF's international

president, Chief Emeka Anyaoku.

"Devastating though the financial credit

crunch has been, it's nothing as

compared to the ecological recession

that we are facing." He said the more

than $2 trillion (£1.2 trillion) lost on

stocks and shares was dwarfed by the up

to $4.5 trillion worth of resources

destroyed forever each year. The

report's Living Planet Index, which is

an attempt to measure the health of

worldwide biodiversity, showed an

average decline of about 30% from 1970

to 2005 in 3,309 populations of 1,235

species. An index for the tropics shows

an average 51% decline over the same

period in 1,333 populations of 585

species. |

|

|

|

|

|

MICEX FALLS 75% SINCE

MAY |

|

|

The

Russian President

Medvedev continues to

scold the world as the

MICEX, the

Moscow stock exchange,

collapses and Russian

oil changes hands for as

little as $10 a barrel

inside the country

suffering from a glut of

over production. This is

a demonstration of the

dangers of too much

government intervention.

The Russian MICEX market

has been the worst

performing in the second

half of this year so

far, reports The

Telegraph. Stocks have

fallen by 75% since May.

A key problem for Russia

is that it is massively

dependent on oil. Its

2009 budget only

balances if oil is

trading at an average

$95 a barrel. I can't

see that happening. So

its markets and the

rouble have come under

pressure with falling

oil prices. And of

course, as an emerging

market, it has taken a

hit as investors pull

their money out and

repatriate it to the

'safe haven' of the US.

But the state's attempts

to prevent the crisis

with brute force, have

only made things worse.

The central bank has

already had to spend

$120bn of its reserves

on defending the rouble,

which analysts reckon is

now 30% over-valued.

This is just a waste of

money. When a country,

particularly a

politically risky

country like Russia,

starts defending its

currency, it's a sure

sign to the market that

said currency is

over-valued. No central

bank in the world has

enough reserves to

defend against a forex

market set on helping a

currency to find its

"real" worth. |

|

|

THE STATE OF

WORLD ECONOMY

RESEMBLES THIS

DRIED OUT MUMMY

BELIEVED TO BE

THE SON OF

RAMESES III |

|

|

|

|

|

POUND STERLING

PLUNGES AS BANK OF

ENGLAND MAKES GRIME ECONOMIC FORECAST FOR UK |

|

|

Whilst others

enjoyed yachts

Champagne and holidays at YOUR expense... |

|

David Cameron was

labelled "Three Yachts" after it emerged

that he spent a second summer holiday

boat hopping in the lap of luxury. At

the same time John Prescott rejected

claims that he led a lavish lifestyle in

Government, insisting he did not enjoy

the wining and dining of high office.

The Conservatives slammed Mr Prescott

for living the “high life”, raking in

thousands on food, drink and travel

expenses heading the “non-job” Deputy

Prime Minister’s Office. Mr Prescott,

who has been fronting a BBC series on

class, denied he had benefited from the

cash and insisted he was only doing the

bidding of former Prime Minister Tony

Blair. |

|

|

|

|

|

Since food prices began to rise

100 million more people have been pushed into poverty,

according to the World Bank, with as many as two billion

on the verge of disaster. Almost half the world's

population, let's remember, live on less than $2.50 per

day. Millions die annually of hunger and starvation, and

more than a billion do not have access to fresh water. |

With the world financial crisis

these numbers are poised to rise dramatically with

population growth, dwindling natural resources and

higher consumer prices across all goods and services. So

as the stock market tumbles and the world economy

falters, it's important to remember that it's more than

financial losses we are talking about, it's the loss of

life. |

|

|