|

|

|

An independent view of the world

seen from Tokelau

The Independent New York Times

Tokelau, Saturday,

December 13,

2008 Weekend Edition, editor

- contact sumpinein@gmail.com

|

|

|

|

|

The

US unemployment rate soared to 6.7% and is

expected to go higher with companies

announcing massive downsizings almost

daily. The country has shed a huge 1.2

million jobs over the last 11 months,

letting 533,000 people go in November

alone. The last time figures such as

this were seen was back in December

1974, when inflation and economic

stagnation were occurring simultaneously

resulting in stagflation. The number of

job losses has obviously impacted hard

on the US residential property market,

and repossessions continue to rise at an

alarming rate, in addition the

commercial sector has seen a real slump

in demand, with office, retail and hotel

space all being affected.

|

|

|

HIGH

DEFAULT RATE FOR MODIFIED HOME LOANS IN

USA |

|

| More than half of delinquent

homeowners whose mortgages were modified

earlier this year ended up re-defaulting

within six months, a top bank regulator

said Monday. Some 53% of borrowers

with loans modified in the first three

months of 2008 and 51% of those with

loans modified in the second quarter

could not keep up with payments within

six months, according to U.S. The high redefault rate raises

concerns about the long-term

effectiveness of loan modifications,

which many are pushing as a key solution

to the nation's financial crisis. A record 1.35 million homes are in

foreclosure, while the number of

borrowers who have fallen behind on

their payments soared to a record 6.99%,

the Mortgage Bankers Association said

last week. Meanwhile, 1.7 million homeowners

have been helped in 2008 through the

Hope Now Alliance, a coalition of

lenders, servicers, investors and

counselors working with delinquent

borrowers on modifications and repayment

plans. Modifications that include an

interest rate reduction have a 15%

redefault rate, said Bair, citing a

recent Credit Suisse study. |

|

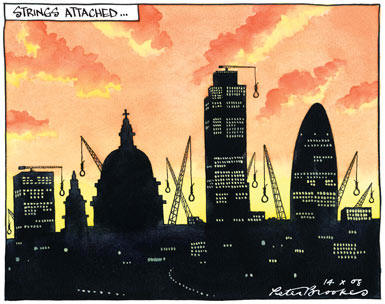

BRITAIN TO JOIN

EURO? |

|

|

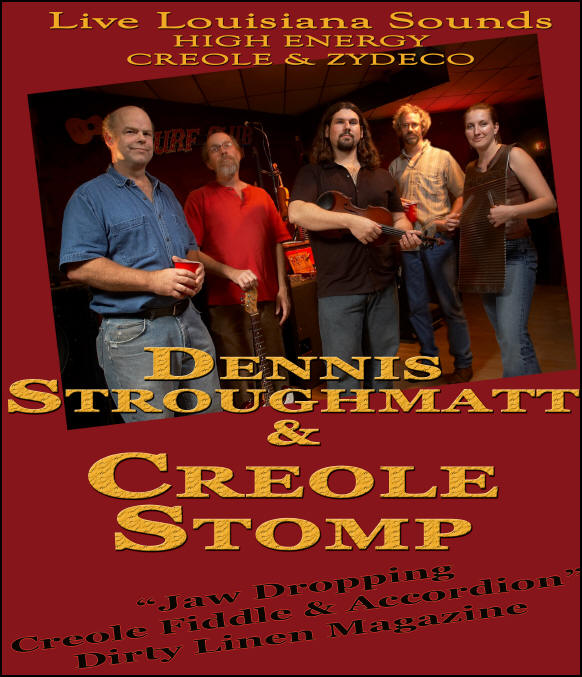

This band

incarnates the traditional

values of Cajun music in the

USA. The Cajuns live mainly in

Louisiana and are the

descendants of Acadian exiles.

Today, the Cajuns make up a

significant portion of south

Louisiana's population, and have

exerted an enormous impact on

the state's culture. |

|

|

|

Every now and

again a band comes along that redefines

a genre of music and carries it even

further...that group is Dennis

Stroughmatt and Creole Stomp. Always

leaving audiences wondering "who are

they?," and "where do they come from?,"

Dennis and CS are based in southern

Illinois and happily tell audiences "we

are from upper Louisiana." While this

may bring chuckles from many and nodding

heads from others "in the know," this is

the group that does represent "old upper

Louisiana." Dennis learned to speak

French and play French Creole music in a

southeast Missouri French Creole

community before moving to the state of

Louisiana. After returning to Illinois

from Louisiana, Dennis began a long

odyssey that eventually culminated in

the forming of Creole Stomp in 2002. And

since that time he and his band have

carried the torch of French Creole music

and culture across North America

performing a blend of music from the

state of Louisiana and old upper

Louisiana. Their unique sound and mix

of ancient and modern Mississippi River

valley musical tradition positions them

as the only band to encompass French

Creole and Folk Music from the entirety

of the old Louisiana Territory. And

although Dennis continues to play with

many of his Louisiana based friends on

occasion, you can always find him at the

helm of Creole Stomp playing

somewhere from San Diego to Boston |

|

|

|

Read DEATH OF A

FINANCIER by JOHN

FRANCIS KINSELLA |

|

Tom Barton, a City

mortgage broker, decides

to quit his business in

the wake of the subprime

crisis and arrives in

Kovalam, in the south of

India. In the Maharaja

Palace he finds himself

in the company of

holiday makers from the

UK, Scandinavia and

Russia. Stephen Parkly,

the CEO of a successful

City bank, and his young

wife Emma are taking a

well earned year end

break. Parkly falls

gravely ill with a

mysterious infection,

whilst back in the City,

unknown to him his

mortgage and investment

bank, West Mercian

Finance is in grave

difficulties. Ryan

Kavanagh, a doctor,

comes to Emma’s aid with

the help of Barton,

after an attempted

cover-up by the Indian

authorities, who fear

for their tourist

industry and more

especially medical

tourism, as the disease

threatens the resort

with the tourist season

in full swing. Thousands

of British tourists

enjoying the sun are

unaware of the pending

disaster, many are

equally unaware their

savings about are to be

wiped out in the West

Mercian collapse. |

|

OR PRINT

VERSION

FROM

| More books by John Francis Kinsella from Vincennes Books: Borneo Pulp, The Legacy of Solomon, Offshore Islands, The Lost Forest |

|

|

|

|

Could

this be the world's

oldest living creature? |

|

|

The span of history

a giant tortoise can

live through is vividly

illustrated in a

remarkable picture on

the British island

colony of St Helena in

the year 1900.

One of the men behind

them (in our second

picture) is believed to

be an Afrikaner captured

during the Boer War,

which lasted from

1899-1902. The remote

South Atlantic island,

the final prison of

Napoleon from 1815 until

his death there in 1821,

later housed a Boer War

prison camp holding

6,000 inmates. The scene is thought

to be the grounds of

Plantation House, the St

Helena governor's

residence in the island

capital of Jamestown,

where three giant

tortoises were brought

as ornamental pets from

the Seychelles in the

Indian Ocean in 1882.

The animals may have

been 50 years old then,

and so would be about 70

when the photo was taken

– and one of the three,

named Jonathan, is still

alive. At a possible age

of 175-plus he would be

the world's oldest

living animal. The

previous oldest-known

tortoise was thought to

be Harriet, a giant

Galapagos land tortoise

who died, aged 175, in

2005 in Australia.

|

|

Lakeview Terrace |

A

gripping film about

neighbourly hate

that inverts racial

stereotypes.

Next door neighbour,

(Eddie Murhpy)

presents himself:

“I’m your worst

fucking nightmare,

man. I’m a nigger

with a badge.” When

Chris and Lisa

Mattson, a nice

mixed-raced couple,

move into their

dream home on a

quiet cul-de-sac in

southern California,

they discover their

worst nightmare

lives next door: a

black cop with a

badge and a hatred

of mixed-race

couples. Lakeview

Terrace belongs to

that genre of

thrillers — Unlawful

Entry, Fatal

Attraction — in

which good, white,

well-off

middle-class people

have their lives

invaded by former

lovers, lunatics or

the neighbour(s)

from hell. But this

is a film directed

by Neil LaBute (In

the Company of Men),

a man who loves to

press the buttons of

his audience —

especially the panic

buttons of

liberal-minded folk.

|

|

|

|

GREECE SWEPT BY RIOTS |

|

Demonstrators

clash with Greek

riot police in

the centre of

Athens, Greece

on 07 December

2008. Civil

unrest broke out

across Greece on

06 December as

hundreds of

demonstrators

clashed with

riot police in

Athens and the

northern port

city of

Thessaloniki in

a second day of

protests

following the

death of a

teenaged boy

shot by police.

|

|

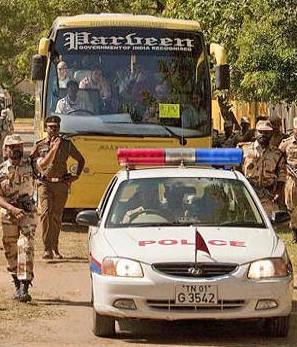

ENGLISH CRICKET

TEAM ARRIVE IN

INDIA |

|

|

THE INDEPENDENT NEW YORK

TIMES PRESENTS A WEEKLY

ROUND-UP OF STORIES AND

PICTURES THAT HAVE MADE

THE NEWS HEADLINES THIS

WEEK |

|

|

|

The

Governor

of

Illinois

was

arrested

yesterday

for

allegedly

trying

to sell

Barack

Obama’s

vacated

US

Senate

seat to

the

highest

bidder.

The

arrest

of Rod

Blagojevich

and John

Harris,

his

chief of

staff,

cast a

light on

the home

state of

the

President-elect,

which

has a

history

of

endemic

corruption. |

|

|

The

charges include

allegations that

the Democratic

governor, who

has served

two-terms,

conspired with

Antoin “Tony”

Rezko, a former

friend and

political donor

of Mr Obama, in

schemes

requiring

individuals and

companies to pay

kickbacks in

return for state

contracts.

Patrick

Fitzgerald, the

federal

prosecutor in

Chicago, said

that the charges

did not allege

any wrongdoing

by the future

president. “I

should make

clear the

complaint makes

no allegations

about the

President-elect

whatsoever,” he

said. Mr

Blagojevich, a

Serb-American

former shoeshine

boy who married

the daughter of

an influential

Chicago

alderman, was

handcuffed and

taken into

custody at his

home at dawn

after asking an

FBI agent: “Is

this a joke?”

After a court

appearance he

was freed last

night on a

$4,500 (£3,000)

bail.

Prosecutors said

that the FBI had

taken

exceptional

measures,

including

tapping the home

telephone of the

governor since

October, because

of a sudden

surge in alleged

corruption. They

said that Mr

Blagojevich was

trying to raise

$2.5 million

(£1.7 million)

in campaign

contributions by

the end of the

year before an

ethics law came

into force to

restrict

donations from

people who do

business with

the state. “We

are in the

middle of a

corruption crime

spree and we

wanted to stop

it,” Mr

Fitzgerald said.

The FBI has

issued a 76-page

affidavit

outlining the

alleged attempt

by Mr

Blagojevich to

extract a price

for exercising

his power to

appoint a

Senator to fill

Mr Obama’s

vacated seat. In

a secretly

recorded

conversation he

allegedly said

that the Senate

seat “is a

fucking valuable

thing, you just

don’t give it

away for

nothing”. In one

taped

conversation Mr

Blagojevich

allegedly

compared his

position to that

of a sports

agent shopping

around for a

sports star

among rival

teams. His

proposed

approach, he

allegedly said,

would be to ask:

“How much are

you offering,

[President-elect]?

What are you

offering,

[Senate

candidate 2]? .

. . Can always

go to . . .

[Senate

candidate 3].”

According to

prosecutors he

initially

discussed

trading the open

Senate seat for

a Cabinet post

or

ambassadorship

in the Obama

administration.

Mr Blagojevich

allegedly sought

a quid pro quo

for offering the

Senate seat to a

close aide of Mr

Obama — believed

to be his friend

Valerie Jarrett,

who later took

herself out of

the running and

who will be a

senior adviser

at the White

House. He then

allegedly

discussed a

three-way deal

where he would

name Ms Jarrett

to the Senate

seat in return

for a

high-paying

position with

Change to Win,

an organisation

affiliated to

the Service

Employees

International

Union. The Obama

administration

would then do an

unspecified

favour for

Change to Win.

Mr Blagojevich

said that he

would prefer,

however, to get

Mr Obama to ask

key donors such

as Warren

Buffett and Bill

Gates to set him

up as head of

his own charity,

with $10-$15

million in

funding,

prosecutors

said. Mr

Blagojevich also

allegedly

suggested that

Mr Obama could

help to get his

wife on to

lucrative

corporate

boards.

Concerned that

Mr Obama did not

want to pay to

get his favoured

candidate into

the Senate, Mr

Blagojevich

allegedly

threatened to

keep the Senate

seat or give it

to someone who

could offer him

cash up front.

In another

secretly

recorded

conversation Mr

Blagojevich

claimed that he

was offered a

deal by an

associate of an

unnamed Senate

candidate 5. “We

were approached

‘pay to play’.

That, you know,

he’d raise 500

grand. An

emissary came.

Then the other

guy would raise

a million, if I

made him [Senate

candidate 5] a

Senator,” the

governor

allegedly said.

|

|

TEHRAN: An

Iranian man has been

sentenced to be blinded

under Islamic laws in

retribution for blinding

a woman by throwing acid

on her face for

rejecting his marriage

proposal, press reports

said on Thursday.

A Tehran criminal court

on Wednesday issued the

ruling against the

jilted suitor identified

as Majid, 27, who

confessed to throwing

acid on Ameneh Bahrami's

face four years ago,

Kargozaran newspaper

said.

Despite years of

treatment in Spain,

Bahrami has lost sight

in both eyes and still

bears serious injuries

to the face and body,

the report said.

The newspaper did not

say whether the convict

would appeal against the

ruling that he also be

blinded by acid.

Under the Sharia-based

law practised in the

Islamic republic, those

convicted of causing

intentional physical

injury are punishable by

"qisas", or the

eye-for-an-eye Islamic

penalty.

|

|

'We have saved the

world' |

|

|

|

Gordon Brown's slip of

the tongue provoked

hilarity in the Commons.

Gordon Brown is

preparing to offer

billions in loan

guarantees to struggling

businesses amid Tory

claims that his bank

rescue scheme is not

working. This autumn Mr

Brown injected £37

billion into High Street

banks to keep them

afloat and offered

taxpayer backing for

bank lending of up to

£250bn. To make matters

worse Germany has

lambasted Gordon Brown’s

response to the economic

crisis as “crass” and

“depressing” in an

astonishing attack as EU

leaders prepare to

debate how to recover

from the recession in

Brussels today.

|

|

|

Barack

Obama’s grandfather was imprisoned and

brutally tortured by the British

|

|

| Barack Obama’s

grandfather was imprisoned and brutally

tortured by the British during the

violent struggle for Kenyan

independence, according to the Kenyan

family of the US President-elect.

Hussein Onyango Obama, Mr Obama’s

paternal grandfather, became involved in

the Kenyan independence movement while

working as a cook for a British army

officer after the war. He was arrested

in 1949 and jailed for two years in a

high-security prison where, according to

his family, he was subjected to horrific

violence to extract information about

the growing insurgency. |

|

DUBAI

ALCOHOL & SEX |

|

| The weekly Le Meridien

brunch has become a byword for

alcohol-fuelled over-indulgence.

Crowds of young European expats

pay just over £50 to eat as much

as they can from the luxury

buffet and drink as much

champagne as possible. It starts

at noon and by 4pm many

customers are extremely drunk

and dancing either on the small

dance floor or on their tables.

On July 4 this year, Acors and

publishing executive Palmer -

then strangers - met at the

same Le Meridien brunch. For the

past five months Acors, a father

of one from Bromley, South

London, and Palmer, from Oakham

in Rutland, have been trapped in

the oil-rich emirate as their

case progressed through its

court system. After being

convicted of public indecency

and having unmarried sex, they

were sentenced to three months

in jail. But two weeks ago the

court of appeal suspended the

sentences and ordered that they

be deported. They are expected

back in the UK next week.

|

|

|

CHINA DEVALUES |

|

The central bank

has shifted the

central peg of

its dollar band

twice this week

in a calculated

move that

suggests Beijing

aims to offset

the precipitous

slide in Chinese

manufacturing by

trying to gain

further export

share abroad.

The futures

markets are

pricing in a 6pc

devaluation over

the next year.

"This is clearly

a big shift in

policy and we

are now on

alert," said

Simon Derrick,

currency chief

at the Bank of

New York Mellon.

The move follows

a Politburo

speech by

President Hu

Jintao warning

that China is

"losing

competitive edge

in the world

market".

|

A

5,300-year-old

mummified

iceman

unearthed in

the Alps may

have been

carrying a

prehistoric

version of

tin foil and

an ancient

first aid

kit. Scots

researchers

found

fragments of

different

mosses in

the stomach

of Oetzi,

whose

remains were

found in the

Italian Alps

in 1991. The

discovery

baffled

scientists,

as mosses

have no

nutritional

value and

would not be

eaten. But

analysis has

revealed he

may have

used one

type of

moss, known

to have

antiseptic

properties,

to dress a

wound.

Another type

could have

been used to

wrap a snack

of red deer

and ibex

meat, like a

Neolithic

version of

tin foil.

Professor

James

Dickson,

senior

research

fellow from

the

University

of Glasgow,

revealed

Oetzi is the

first

glacier

mummy to

have

fragments of

mosses in

his

intestine.

He said:

“Mosses are

not

nutritious

or

palatable,

so you can’t

say he was

eating it.

My

explanation

is that it

was in

contact with

the food he

was carrying

or perhaps

wrapping

it.” Oetzi

had suffered

a deep gash

on his right

hand shortly

before he

died and a

fragment of

Bogmoss

discovered

in the

stomach may

have been

used for its

antiseptic

properties.

Professor

Dickson

said: “Bog

mosses were

used as

wound

dressings

right up

until the

Second World

War. “We

don’t know

if

prehistoric

people knew

of these

properties,

but my

opinion

would be

that they

did.” The

research is

published in

the journal

Vegetation

History and

Archaeobotany.

|

|

|

WOOLIES GOES BUST 30,000 JOBS

TO GO |

|

A high

street symbol in the UK Woolworths

begins a closing down sale today after

administrators admitted that efforts to

keep the chain intact have come to

nothing. The retailer was put into

administration two weeks ago after it

was overwhelmed by mounting debt.

Now, the administrators, from accountancy firm Deloitte, are having to

settle for selling chunks of stores from

the 815 outlets under the Woolworths

umbrella. Woolworths started life

as a penny and sixpence store, but

became the place where generations of

teenagers would buy a pop single or a

bag of pick 'n' mix sweets. Deloitte has

already cut 450 administrative jobs at

Woolworths offices in London and

Castleton, near Rochdale. The chain

employs about 30,000 in total.

|

|

|

BRITISH PRESS

MOCKS 'FLASH GORDON' BROWN |

|

|

FOR TOURISTS ONE EURO ALREADY

EQUALS ONE POUND |

|

|

|

|

|

|

DETROIT STILL WAITING |

|

Detroit depended

largely on SUVs

for sales and

profits for many

years. But those

vehicles were

very popular,

and there was

very little

competition from

foreign

automakers. In

2002, General

Motors sold more

than 2.8 million

light trucks

including 1.2

million SUVs.

That was an

increase of 6.2%

from the year

earlier. That

same year, GM

sold 2.3 million

cars, a drop of

almost 9% from

the previous

year. When gas

prices spiked in

2007, buyers

suddenly shifted

to smaller cars.

That was quickly

followed by an

economic crisis

that drove down

sales of all

types of

vehicles. But

trucks remain an

important part

of Detroit

automakers'

product

strategies. Even

with marker

share for cars

increasing, GM

sold more trucks

than cars in

October General Motors

Corp reported a

41 percent drop

in overall U.S.

sales for

November, saying

continued

economic

uncertainty was

hurting consumer

confidence.

The sales

results,

reported on

Tuesday, came as

the No.1 U.S.

automaker was

set to submit an

extensive

restructuring

plan to Congress

in support of a

$25 billion

rescue package

for the auto

industry. GM

sold 154,877

vehicles in the

U.S. market in

November,

compared with

263,654 a year

earlier. The

company said it

was extending a

"Red Tag" sale

with lower

vehicle prices

and cash-back

offers through

Jan. 5. GM

expects

first-quarter

2009 production

in North America

to be down 32

percent from a

year earlier,

based on a plan

to build 600,000

cars and trucks

in the period,

it said. "The

consumer is

scared and

sitting on the

sideline. We

need appropriate

economic

stimulus to get

the consumer

back in the

game," GM U.S.

sales chief Mark

LaNeve said in a

statement. GM

estimated that

industry wide

U.S. vehicle

sales dropped 34

percent in

November,

extending a

downturn that

has accelerated

amid financial

market turmoil.

|

|

Celebrity

crunch: property

firm to the

stars, aAim,

goes bust |

|

|

The

plummeting

property market

claimed a host

of celebrity

victims

yesterday when

companies whose

investors

include Sir Alex

Ferguson, Sir

David Frost and

Grant Bovey

collapsed into

administration.

The Times has

learnt that aAim,

a £3 billion

property

investment

company backed

by HBOS and

chaired by Sir

David, has gone

into

administration.

It is feared

that

shareholders

will lose all

their

investments.

aAim spent

billions of

pounds on

properties in

Britain and

mainland Europe,

before the

market fell last

summer. Property

prices in

Britain have

dropped by as

much as 35 per

cent since then.

aAim had a

number of

well-known

sponsors. Sir

Alex, the

Manchester

United manager,

was still listed

as a founder

shareholder and

investor last

night. “I have

been impressed

by the energetic

team, their

clarity of

vision and by

the consistent

high returns

they have

delivered,” Sir

Alex is quoted

as saying.

|

|

|

|

|

REAL ESTATE DOWNFALL DRAMA |

|

|

|

DRAMATIC PICTURES OF F-18 CRASH IN

RESIDENTIAL SAN DIEGO SUBURB |

|

|

|

An Australian, who works as a mailman in the US,

has told of his escape when a fighter jet

crashed, killing at least three people. Bill

Dusting, formerly of St Kilda, said he managed

to dive for cover as an F/A-18D Hornet slammed

into a San Diego street, flattening houses and

killing residents. Mr Dusting, 48, was on his

midday mail round of the middle-class

neighbourhood near Miramar navy base when he

heard the loud pop of the pilot ejecting from

the jet. "I heard a bang, bang and I thought

someone was shooting at me," Mr Dusting said. "I

looked up and saw the parachute and then I saw

the jet, which was pretty much heading straight

at me." Mr Dusting said he sprinted away from

the house. "I'm running and it's coming closer

and I thought, 'Damn, it's coming at me like a

magnet' but I chose the right direction, running

right instead of left," he said. Moments later,

he said the jet appeared to smash through the

front door of the house, then into another two

homes before crossing the street and crashing

into at least two more houses. "When it hit the

first one it virtually evaporated and then the

smoke ... the flames trailed from the house next

to it, behind it and the flames trailed across

the street," he said. Mr Dusting said it was

"absolute carnage" and compared the scene to a

war zone in Iraq. He said the first house

usually had trucks parked outside and he had

believed no one was at home. He rang emergency

services. Three people have been reported killed

and one other remains missing. Mr Dusting has

delivered mail in the area for 15 years after

moving to the United States to marry his wife.

He said residents of the area were used to the

sound of jets overhead from the Miramar base,

made famous by the movie Top Gun. Mr

Dusting said it had been a quiet morning in the

neighbourhood and he was the only person on the

street when the jet careered into the ground.

Within minutes, distressed neighbours were

running to the scene. "I've never seen such a

quick response from police, fire department and

obviously some very secret black vehicles with

black windows coming in because you can imagine

what's going to go down with this being a navy

crash," he said. Mr Dusting said he was still in

shock, felt lucky to be alive and was about to

call his 89-year-old mother in Australia. "When

I saw everything was totally cool I just lost it

and got home, laughed, cried and I'm just

getting it together now," he said. "You've got

no idea how close it was. Looking at some of the

pictures ... at where the shrapnel was and where

I must have been, it must have been a good

dive." |

|

|

|

CORPORATE JET CUT BACKS |

| It is the great company jet fire

sale. Everything must go – and quickly.

For the credit-crunched giants of

corporate America, living on the

generosity of the taxpayer, it ill

behoves executives to fly luxury class,

and a string of expensive aircraft are

finding their way on to the market.

The bosses of the big three Detroit

car-makers were making a

self-flagellating road trip yesterday

from Motor City to Washington, where

they will plead for a $34bn (£23bn)

government hand-out this morning, a

fortnight after being ridiculed for

turning up at their last meeting on

$20,000-per-flight corporate jets. And

Citigroup, which just 10 days ago palmed

off up to $306bn in potential losses on

to the US government, was also reported

to be selling two of its fleet of

aircraft, decked out with lush dining

chairs and a well-stocked kitchen. The sales threaten to usher in an era

of penury for a cadre of executives who

are used to flying on the company jet

not just for business trips but also on

holiday. For the American public, bitter

at forking out more than $1trn so far

during the credit crisis to bail out

Wall Street banks and other companies,

it offers one small signal that

boom-time corporate excess is being

curbed. A small Maryland broker is hawking

two Dassault Falcon jets understood to

belong to Citigroup, the banking giant

brought to the brink of bankruptcy last

month by billions of dollars of losses

on sub-prime mortgages. The government

has already put in $45bn from the

bailout fund and promised more if

necessary. |

|

|

|

|

|

Since food prices began to rise

100 million more people have been pushed into poverty,

according to the World Bank, with as many as two billion

on the verge of disaster. Almost half the world's

population, let's remember, live on less than $2.50 per

day. Millions die annually of hunger and starvation, and

more than a billion do not have access to fresh water. |

With the world financial crisis

these numbers are poised to rise dramatically with

population growth, dwindling natural resources and

higher consumer prices across all goods and services. So

as the stock market tumbles and the world economy

falters, it's important to remember that it's more than

financial losses we are talking about, it's the loss of

life. |

|

|