|

AWARDS AND TEARS |

|

|

Kate Winslet

has won two Golden Globe awards in one of the

best nights for British talent in recent memory.

The Reading-born actress, 33, picked up gongs

for best supporting actress for The Reader, in

which she plays former Nazi guard who has an

affair with a younger man, and for best actress

for her role as a frustrated suburban housewife

in Revolutionary Road. The actress was rendered

speechless by the second win – one of the more

unexpected of the night. "Is this really

happening," she asked in an emotional address

that paid tribute to her "spectacular" co-star,

Leonardo DiCaprio,

and to her husband, Sam Mendes, who directed the

film. |

|

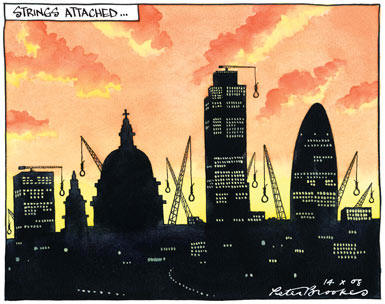

SECOND WAVE OF BANKING CRISIS HITS

STERLING |

|

|

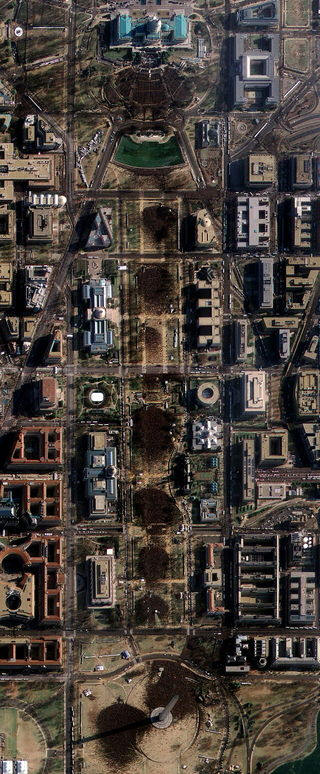

SEEN

FROM SPACE |

|

|

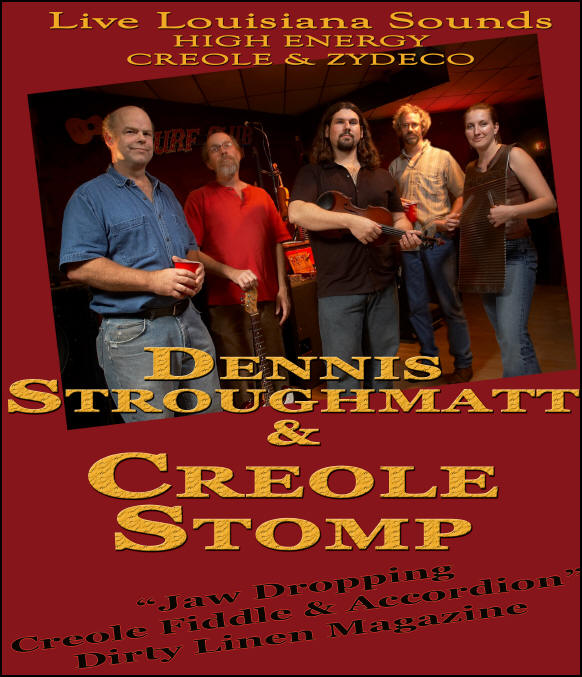

This band

incarnates the traditional

values of Cajun music in the

USA. The Cajuns live mainly in

Louisiana and are the

descendants of Acadian exiles.

Today, the Cajuns make up a

significant portion of south

Louisiana's population, and have

exerted an enormous impact on

the state's culture. |

|

|

|

Every now

and again a band comes along that

redefines a genre of music and carries

it even further...that group is Dennis

Stroughmatt and Creole Stomp.

Always leaving audiences wondering "who

are they?," and "where do they come

from?," Dennis and CS are based in

southern Illinois and happily tell

audiences "we are from upper Louisiana."

While this may bring chuckles from many

and nodding heads from others "in the

know," this is the group that does

represent "old upper Louisiana." Dennis

learned to speak French and play French

Creole music in a southeast Missouri

French Creole community before moving to

the state of Louisiana. After

returning to Illinois from Louisiana,

Dennis began a long odyssey that

eventually culminated in the forming of

Creole Stomp in 2002. And since that

time he and his band have carried the

torch of French Creole music and culture

across North America performing a

blend of music from the state of

Louisiana and old upper Louisiana.

Their unique sound and mix of ancient

and modern Mississippi River valley

musical tradition positions them as the

only band to encompass French Creole and

Folk Music from the entirety of the old

Louisiana Territory. And although

Dennis continues to play with many of

his Louisiana based friends on occasion,

you can always find him at the helm of

Creole Stomp playing

somewhere from San Diego to Boston |

|

|

|

Read DEATH OF

A FINANCIER by

JOHN FRANCIS KINSELLA |

|

Tom Barton, a City

mortgage broker, decides

to quit his business in

the wake of the subprime

crisis and arrives in

Kovalam, in the south of

India. In the Maharaja

Palace he finds himself

in the company of

holiday makers from the

UK, Scandinavia and

Russia. Stephen Parkly,

the CEO of a successful

City bank, and his young

wife Emma are taking a

well earned year end

break. Parkly falls

gravely ill with a

mysterious infection,

whilst back in the City,

unknown to him his

mortgage and investment

bank, West Mercian

Finance is in grave

difficulties. Ryan

Kavanagh, a doctor,

comes to Emma’s aid with

the help of Barton,

after an attempted

cover-up by the Indian

authorities, who fear

for their tourist

industry and more

especially medical

tourism, as the disease

threatens the resort

with the tourist season

in full swing. Thousands

of British tourists

enjoying the sun are

unaware of the pending

disaster, many are

equally unaware their

savings about are to be

wiped out in the West

Mercian collapse. |

|

OR PRINT

VERSION

FROM

| More books by John Francis Kinsella from Vincennes Books: Borneo Pulp, The Legacy of Solomon, Offshore Islands, The Lost Forest |

|

|

|

|

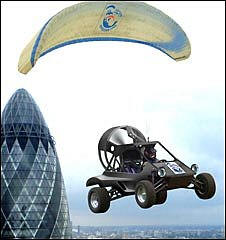

LONDON TO TIMBUKTU BY

FLYING-CAR |

|

|

A voyage to fabled

Timbuktu in a flying car

may sound like a magical

childhood fantasy.

But this week a British

adventurer will set off

from London on an

incredible journey

through Europe and

Africa in a souped-up

sand buggy, travelling

by road - and air. With

the help of a parachute

and a giant fan-motor,

Neil Laughton plans to

soar over the Pyrenees

near Andorra, before

taking to the skies

again to hop across the

14-km (nine-mile)

Straits of Gibraltar.

The ex-SAS officer then

aims to fly over the

Atlas Mountains in

Morocco, above stretches

of the Sahara desert

and, well, wherever else

the road runs out. But

forget Chitty Chitty

Bang Bang - this flying

machine is based on

proven technology.

|

|

|

Lakeview Terrace |

A gripping film

about neighbourly

hate that inverts

racial stereotypes.

Next door neighbour,

(Eddie Murhpy)

presents himself:

“I’m your worst

fucking nightmare,

man. I’m a nigger

with a badge.” When

Chris and Lisa

Mattson, a nice

mixed-raced couple,

move into their

dream home on a

quiet cul-de-sac in

southern California,

they discover their

worst nightmare

lives next door: a

black cop with a

badge and a hatred

of mixed-race

couples. Lakeview

Terrace belongs to

that genre of

thrillers — Unlawful

Entry, Fatal

Attraction — in

which good, white,

well-off

middle-class people

have their lives

invaded by former

lovers, lunatics or

the neighbour(s)

from hell.

|

|

|

|

CHINESE GROWTH ZERO? |

|

Although the

annual rate of

growth was

6.8pc,

economists

speculated that

the actual

growth between

September and

December last

year could have

been zero, or

even negative.

The annual rate

of growth for

the world's

third-largest

economy was the

lowest since the

second quarter

of 1998. "The

international

financial crisis

is deepening and

spreading with a

continuing

negative impact

on the domestic

economy," said

Ma Jiantang,

head of the

statistics

bureau. In

China, much of

the slowdown has

been blamed on a

lack of demand

from the rest of

the world for

Chinese-made

goods. Wen

Jiabao, the

prime minister,

said earlier

this week that

the outlook for

Chinese

employment is

"very grim" as

factories shut

down and foreign

companies rein

in their

spending.

Mr Wen will

visit the UK

next week, and

Gordon Brown has

already called

upon him to make

sure that China

plays its part

in stabilising

the global

economy. "We

need China to

play a full

role, in

partnership with

us, if we are to

restore

confidence,

growth and

jobs," said Mr

Brown. China,

however, has

insisted that it

must get its own

house in order

first, and there

are indications

that the

government has

already

instructed banks

to unleash

credit into the

market. The

value of loans

issued in

November and

December soared

by nearly 19pc.

"It is hard to

overestimate the

potential

importance of

this," said Mr

Green. "Mature

economies'

banking systems

are currently

flooded with

liquidity that

is not being

lent out.

China's

interbank market

is similarly

flooded, but the

difference is

that the banks

are lending."

The banks are

likely to be

ordered to

finance a large

chunk of the

Pounds400

billion fiscal

stimulus package

that the Chinese

government

announced in

November. There

is a further

Pounds2 trillion

of spending

demands from

local

governments

across China

that they may

also be called

upon to help

with,

irrespective of

the possibility

of bad loans.

China was not

alone in its

difficulties

Japanese

exporters also

endured a hard

December as

demand for a

range of goods

fell sharply.

Exports to the

US fell 26pc,

those to Europe

dropped 41.8pc

and those to

China were down

35pc.

|

|

Nevertheless,

the

International

Red Cross

continues to

meet with the

relevant Israeli

authorities to

persuade them of

Israel's

international

obligations as a

signatory to the

convention. Eloi

Fillion,

protection

coordinator of

the

International

Committee of the

Red Cross,

explained to the

Middle East

Times that his

organization

also holds

regular

workshops on

principles of

international

humanitarian law

for Israeli

security

personnel and

members of the

IDF, which he

says are

positively

received. But,

he said, there

was only so much

that groups like

his could do, as

ultimately the

protection of

Palestinian

civilians lay in

a negotiated

settlement.

"Until there is

a political

settlement to

the

Palestinian-Israeli

conflict,"

Fillion said,

"the majority of

casualties will

continue to be

civilian, who

will also bear

the brunt of the

suffering."

|

|

|

MIDDLE EAST

FACTS

|

|

On 29 November

1947, the

United Nations

General Assembly

voted 33 to 13,

with 10

abstentions, in

favour of the

Partition Plan,

while making

some adjustments

to the

boundaries

between the two

states proposed

by it. Switching

their votes from

November 25 to

November 29 to

provide the

two-thirds

majority were

Liberia, the

Philippines, and

Haiti. All

heavily

dependent on the

United States,

they had been

lobbied to

change their

votes. The State

Department noted

that it had been

shown that

unauthorized

U.S. pressure

groups,

including

members of

Congress, sought

to impose U.S.

views on members

of foreign

delegations. At

that time Israel

as a state did

not exist and

the UN was

composed of only

54 nations and

all Middle East

members voted

against the

resolution,

whilst South

Africa, then

under apartheid,

was the only

African nation

to vote for the

resolution,

since there was

no other African

member state,

except Egypt who

voted against.

Since that time

the total member

states risen to

192. It is of

course difficult

to change

history and past

resolutions, but

some

consideration

should be given

to the changes

that have taken

place in the

world whilst

protecting the

position of

Israel, as well

as the

Palestinian

people - a small

and weak nation

facing a

regional

superpower. |

|

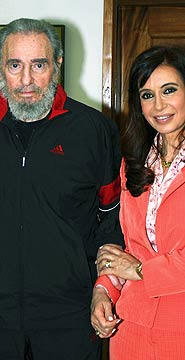

I'll be gone

before Obama

finishes term,

says Fidel

Castro |

|

|

THE INDEPENDENT NEW YORK

TIMES PRESENTS SEASONAL

GREETINGS TO ALL ITS

READERS

PLEASE LET US HAVE

YOUR COMMENTS AND

OPINIONS

CONTACT OUR EDITOR AT

sumpinein@gmail.com |

|

|

|

Caroline

Kennedy

announced

early

Thursday

that she

was

withdrawing

from

consideration

for the

vacant

Senate

seat in

New

York,

startling

the

state’s

political

world

after

weeks in

which

she was

considered

a top

contender

for the

post. |

|

|

Ms. Kennedy on

Wednesday called

Gov.

David A.

Paterson,

who will choose

a successor to

Senator

Hillary Rodham

Clinton,

to inform him

that she was no

longer

interested. “I

informed

Governor

Paterson today

that for

personal reasons

I am withdrawing

my name from

consideration

for the

United States

Senate,”

Ms. Kennedy said

in a statement

released by her

public relations

firm. Ms.

Kennedy did not

elaborate, but a

person who spoke

to her suggested

that her

concerns about

the health of

her uncle,

Senator

Edward M.

Kennedy,

who suffers from

brain cancer and

was hospitalized

after a seizure

on Tuesday,

contributed to

her decision.

Ms. Kennedy

believed that

the job was hers

if she would

accept it, the

person said, but

aides to Mr.

Paterson would

not comment on

whether that was

true. |

|

|

Laurent Nkunda,

the Congolese

general who has

been fighting a

bloody war

against the

government was

arrested last

night in

neighbouring

Rwanda, the

chief of police

in the

Democratic

Republic of

Congo said in a

statement on

Friday. The DR

Congo army and

Rwandan army

"inform the

public of the

arrest of

deposed general

Laurent Nkunda

Thursday at

10:30 pm while

fleeing in

Rwandan

territory after

putting up brief

resistance,"

said the

statement. DR

Congo and

Rwandan troops

advanced on

Thursday on

Nkunda's

headquarters at

Bunangana in the

Nord-Kivu region

of the east of

the country.

Rwanda sent

thousands of

troops into

Congo on Tuesday

as part of a

joint agreement

to eradicate

Rwandan Hutu

rebels based

across the

border and quash

a revolt by

Tutsis against

Kinshasa.

READ John Le Carré's

novel 'The Mission

Song'. |

|

TEHRAN: An Iranian man

has been sentenced to be

blinded under Islamic

laws in retribution for

blinding a woman by

throwing acid on her

face for rejecting his

marriage proposal, press

reports said on

Thursday.

A Tehran criminal court

on Wednesday issued the

ruling against the

jilted suitor identified

as Majid, 27, who

confessed to throwing

acid on Ameneh Bahrami's

face four years ago,

Kargozaran newspaper

said.

Despite years of

treatment in Spain,

Bahrami has lost sight

in both eyes and still

bears serious injuries

to the face and body,

the report said. The

newspaper did not say

whether the convict

would appeal against the

ruling that he also be

blinded by acid.

Under the Sharia-based

law practised in the

Islamic republic, those

convicted of causing

intentional physical

injury are punishable by

"qisas", or the

eye-for-an-eye Islamic

penalty.

|

|

ICELAND

THREATENS UK |

|

|

It is a sign of the

times that security has

been increased at

Reykjavik's small

Parliament building,

from one policeman to

three. Iceland's

Prime Minister Geir

Haarde faces almost

daily calls for his

resignation from small

but angry protests - and

has even been seen with

an armed bodyguard at

the gym. The crisis that

saw Iceland's three

largest banks collapse

in October also soured

relations with Britain.

And while Mr Haarde

insists "we need to move

on", he also insists his

government is

considering court action

against the UK. "I think

there's a special case

with regard to Kaupthing

which needs to be looked

into," he says,

referring to Iceland's

biggest bank which

collapsed on 9 October.

A decision on whether to

go to court is expected

by early January,

focusing on action by

the British authorities

to put the UK operations

of the bank's

subsidiary, Kaupthing,

Singer and Friedlander (KSF),

into administration. "We

are looking at whether

or not the action of the

FSA (Financial Services

Authority) led to the

collapse of Kaupthing,

Singer and Friedlander

in the UK, which in turn

led to the collapse of

the mother bank here in

Iceland," he says.

Iceland's financial

sector imploded over 11

unprecedented days.

First Glitnir, the

third-largest bank, was

nationalised on 29

September, then

Landsbanki, the

second-largest, was

taken over under

emergency legislation on

7 October. |

|

'We have saved the

world' |

|

|

|

Gordon Brown's slip of

the tongue provoked

hilarity in the Commons.

Gordon Brown is

preparing to offer

billions in loan

guarantees to struggling

businesses amid Tory

claims that his bank

rescue scheme is not

working.

|

|

|

SPECIAL RELATIONSHIP? |

|

| Barack Obama’s

grandfather was imprisoned and brutally

tortured by the British during the

violent struggle for Kenyan

independence, according to the Kenyan

family of the US President-elect.

Hussein Onyango Obama, Mr Obama’s

paternal grandfather, became involved in

the Kenyan independence movement while

working as a cook for a British army

officer after the war. He was arrested

in 1949 and jailed for two years in a

high-security prison where, according to

his family, he was subjected to horrific

violence to extract information about

the growing insurgency. |

IMAMS

AND RABBIS GATHER TO PROMOTE

PEACE

Paris,

15 December 2008, the Foundation

Hommes de Parole inaugurated the

Third World Congress of Imams

and Rabbis for Peace at UNESCO.

The theme of the Congress is

The Sacredness of Peace. Paris,

15 December 2008, the Foundation

Hommes de Parole inaugurated the

Third World Congress of Imams

and Rabbis for Peace at UNESCO.

The theme of the Congress is

The Sacredness of Peace.

Abdoulaye Wade, President of the

Republic of Senegal and

President of the Organisation of

the Islamic Conference and Mr

Koïchiro Matsuura, Director

general of UNESCO opened the

proceedings.

|

|

|

CHINA DEVALUES |

|

The central bank

has shifted the

central peg of

its dollar band

twice this week

in a calculated

move that

suggests Beijing

aims to offset

the precipitous

slide in Chinese

manufacturing by

trying to gain

further export

share abroad.

The futures

markets are

pricing in a 6pc

devaluation over

the next year.

"This is clearly

a big shift in

policy and we

are now on

alert," said

Simon Derrick,

currency chief

at the Bank of

New York Mellon.

The move follows

a Politburo

speech by

President Hu

Jintao warning

that China is

"losing

competitive edge

in the world

market".

|

|

Guy Ritchie

will receive

almost £50

million in

cash and

property in

what may be

the largest

divorce

settlement

paid to a

man, a

spokeswoman

for his

former wife,

Madonna,

said last

night. The

film

director and

the pop

singer were

granted a

divorce

settlement

in the High

Court last

month.

Ritchie, who

has an

estimated

fortune of

£30 million,

was

originally

reported not

to be asking

for any

money from

his

wealthier

wife, whose

fortune is

estimated at

£300

million. The

split, via a

“quickie”

procedure,

was held up

by lawyers

as a model

separation,

devoid of

acrimony,

and

Ritchie’s

apparent

refusal to

demand a

share of his

former

wife’s

fortune was

praised as a

rare act of

integrity.

Last night,

however,

Madonna’s

spokeswoman,

Liz

Rosenberg,

said that

Ritchie

would

receive a

figure of

between $76

million and

$92 million

(£49 million

and £60

million) in

cash and

property.

This

includes the

couple’s

country

home,

Ashcombe

House, in

Wiltshire.

worth an

estimated

£10 million

to £12

million, and

their West

London pub,

the

Punchbowl,

which they

bought for

£2.5

million.

Their

settlement

is about

twice the

amount that

Sir Paul

McCartney

paid to

Heather

Mills.

|

|

|

House prices likely to fall for up to

six years suggests latest research from

Harvard University Latest academic

study on impact of previous financial

crises suggests house prices have a long

way to go both in duration and magnitude

of fall (average of -36%). Authors say:

"An examination of the aftermath of

severe financial crises shows deep and

lasting effects on asset prices, output

and employment. Unemployment rises and

housing price declines extend out for

five and six years, respectively.” |

|

|

Anglo Irish Bank Nationalized |

|

The state had planned on

pumping 1.5bn euros (£1.4bn) into the bank, but

has decided that recapitalisation is not the way

to secure its future. Anglo Irish has about 100

billion euros on its books, but there was no

need for customers to act, the state said. It

added that all employees would stay with the

firm and that shareholder rights would be

protected. The bank's board said it would work

with the government to ensure its long-term

commercial viability. Ministers had been due to

hand over the 1.5bn euros bail-out in return for

75% shares with an annual fixed dividend being

paid to the government of 10%. "In the current

circumstances the State is the only available

potential owner," the government said. "I would

again stress that this government decision

safeguards the interest of the depositors of

Anglo, and the stability of the economy, given

the significance of Anglo in this regard, as

already recognised by the European Commission,"

said finance minister Brian Lenihan. "The bank

will continue to operate as normal and

depositors and creditors should continue to

transact as normal." A lack of liquidity has

made it increasingly difficult for the banks to

lend money to their customers. And confidence in

Irish banks has been undermined by the global

credit crunch. They have been especially badly

hit by a slump in the Irish property market

which has led to a collapse in the value of

investments linked to the property market. In

October the government of the Irish Republic

acted to shore up its financial system by

guaranteeing all deposits in the republic's

banks and all money borrowed by the banks from

other financial institutions. This led to many

savers in the UK putting money there as it came

before the UK government had boosted its

protection for savings. According to latest

figure released at the end of September, 50% of

the money saved with Anglo Irish came from UK

customers. Anglo Irish recently lost top

executives over a secret loans fiasco. In

December the bank's chairman resigned after a

87m euros loan controversy. Sean Fitzpatrick

confirmed that he had transferred millions of

euros out of the Dublin-based bank's accounts.

Chief executive David Drumm announced his

resignation shortly afterwards. |

|

POUND

STERLING FACING DIFFICULT DAYS |

| The pound is a currency with no underpinning

and should fall against the dollar and the euro,

says Jim Rogers, chairman of Rogers Holdings and

co-founder of the Quantum Fund with George Soros.

He says his view reflects the UK’s dire economic

situation: “It’s simple, the UK has nothing to

sell.” Mr Rogers says the two main pillars of

support for sterling have been North Sea oil and

the strength of the UK financial services

sector, in particular, the City of London’s

role. But Mr Rogers says just as North Sea oil

is running out, so London’s standing as a major

financial centre is set to suffer. “I don’t

think there is a sound UK bank now, at least, if

there is one I don’t know about it,” he says.

“The City of London is finished, the financial

centre of the world is moving east. All the

money is in Asia. Why would it go back to the

west? You don’t need London,” says Mr Rogers. Mr

Rogers thinks the pound is more vulnerable than

the dollar or the euro. He says the UK housing

market is arguably in a worse state than that of

the US, given pockets of strength in the US and

prices that are sliding across the board in the

UK. Meanwhile, he says, the UK is in worse shape

economically than the eurozone, where most

countries are not big debtors and do not run

huge trade deficits. “If the UK discovers more

North Sea oil, I might change this view,” he

says. “But I don’t see that happening.” The

controversial comments from the investor and

author came as fresh evidence emerged that the

UK’s economy is falling deeper into recession.

UK unemployment rose to its

highest level since 1997 in the three months

to November, while mortgage lending fell to a

fresh record low in December. New figures

released on Wednesday also showed

UK public finances were deteriorating.

December’s budget deficit – tax receipts minus

expenditure – totalled £11.4bn against a

shortfall of £4bn a year earlier, partly because

of the £20bn state recapitalisation of the Royal

Bank of Scotland which swelled the government’s

net cash requirement to £44.2bn. The pound,

which on Monday was trading as high as $1.4909

against the dollar, dropped to a low of $1.3713.

This was its lowest level in more than seven

years and just above the 23-year low of $1.3682

it hit in June 2001. The pound recovered some

ground to stand down 1.3 per cent at $1.3730 by

late morning in New York. Sterling also fell 1.1

per cent to £0.9370 against the euro and lost

3.8 per cent to a record low of Y120.16 against

the yen. Meanwhile, the minutes of the Bank of

England’s

January meeting did nothing to support

sterling, showing that eight members of its

nine-strong Monetary Policy Committee voted for

a 50 basis point cut in interest rates with the

one dissenter voting for a more aggressive 100

basis-point move. The pound has fallen sharply

this week, losing more than 7 per cent against

the dollar, amid uncertainty over government

attempts to bail out UK banks and fears of a

creeping nationalisation of the sector. Analysts

said given the UK bank bail-out had failed to

help lift investor sentiment, unorthodox

monetary policy steps looked more likely from

the Bank of England now that interest rates were

approaching zero. |

|

|

|

|

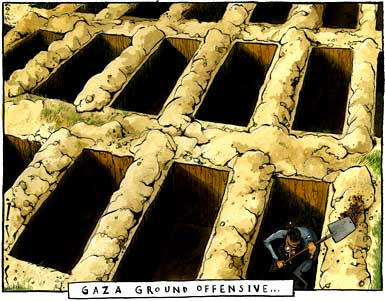

GAZA CONFLICT |

|

|

Hours after

Israel

declared a

cease-fire

on Sunday,

Hamas

declared one

of its own,

announcing

that Israeli

forces had

one week to

leave Gaza.

Still,

Palestinian

militants in

Gaza fired

at least 15

rockets at

southern

Israel,

including a

couple after

the militant

groups’

cease-fire

was

announced.

Most landed

without

causing

casualties,

but one

struck a

house in the

Israeli port

city of

Ashdod,

lightly

wounding one

person. More

than 1,300

Palestinians

died and

5,000 were

wounded.

Israel

unilaterally

called off

its

offensive,

political

leaders and

the military

have

emphasized

that Israel

would

respond to

any attacks.

Israeli

forces

remain in

the north

and south of

Gaza and

along the

eastern

border. The

United

Nations has

reported

that forces

have begun

to withdraw

from some

areas in

Gaza

City

and

Rafah

after the

cease-fire.

Last Sunday,

aid workers

said they

recovered

100 bodies

from areas

where the

Israeli army

has left.

The number

of dead is

expected to

rise as the

army

completes

its

withdrawal

and aid

workers are

able to

access

damaged

buildings.

|

|

UK CLOSING DOWN

SALE EVERYTHING MUST GO! |

|

The London

Evening Standard

owned by Russian

Russian

billionaire

Alexander

Lebedev, former

Soviet spy, paid

just £1 for the

only remaining

London evening

newspaper The

Evening Standard

and said he

plans to pump

tens of millions

into it. The

paper reports

the British

economy is,

quote: ‘... bad,

but not as bad

as we fear ...

the news comes

at the end of a

week in which

we've seen yet

more banking

woes, further

job losses and a

dismissal of our

chances of

recovery from US

investment guru,

Jim Rogers.

Before you jump,

consider the

following. A

good major

business hasn't

gone down yet.

There's been no

failure that has

caused me to

pull up short —

all the

collapses that

dominated the

news are

predictable.

They were in

God's waiting

room anyway —

fewer customers

and a tightening

of credit is all

it took to send

them under.

Travel around

and some areas

of the country

seem far less

affected than

others. And

Bernard Lewis,

the founder of

River Island,

says today: “I

went into the

malls last

Saturday and

they were busy —

not just us. You

can go around

the shops and

think — what

recession? There

is simply no

evidence of it.”

In property, the

number of

would-be buyers

registering with

estate agents

has risen to its

highest since

2006. In the US,

there are

stirrings of

housing on the

move again. But

before I do a

Baroness Vadera

and hail the

arrival of green

shoots (since

the minister

uttered her

words and was

ridiculed, the

order has gone

out across

Whitehall to

keep quiet), it

may prove to be

illusory.

Certainly, in

the South-East,

the impact of

the shattered

City continues

to be felt. And

there are those

who think we're

another Iceland

in the making.

Among them,

Rogers. His view

that we're too

reliant on North

Sea oil is wrong

— as Royal Bank

of Scotland

points out,

we've been

running an oil

deficit for

years, well

before the last

drop from the

North Sea

expires. It's

not a big deal.

Likewise, his

claim that we

have nothing to

sell is also

misleading. UK

exports, RBS

reports again,

reached almost

30 per cent of

GDP in 2006-07.

The City, upon

which attention

is focused, is

not as vital as

is commonly

supposed. Given

a bust bank can

find reasons to

be cheerful says

it all. Yes,

we're in

recession but it

won't last

forever. When it

does, we may

just emerge

stronger and

certainly wiser.

I promise I

didn't write

this with my

fingers crossed.

There is cause

for optimism,

there is…’ |

|

|

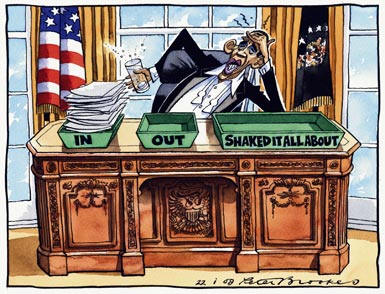

HIC! DID YOU

SAY

ALKA-SELTZER? |

|

|

|

|

|

USA

AIDS AFRICAN STATE MILITARY |

|

Thousands of miles

from the battlefields of Iraq and

Afghanistan, another side of America’s

fight against terrorism is unfolding in

this remote corner of West Africa.

American Green Berets are training

African armies to guard their borders

and patrol vast desolate expanses

against infiltration by

Al Qaeda’s

militants, so the United States does not

have to. |

|

|

A recent exercise

by the United States military here was

part of a wide-ranging plan, developed

after the Sept. 11 attacks, to take

counterterrorism training and assistance

to places outside the Middle East, like

the Philippines and Indonesia. In

Africa, a five-year, $500 million

partnership between the State and

Defense Departments includes Algeria,

Chad, Mauritania, Mali, Morocco, Niger,

Nigeria, Senegal and Tunisia, and Libya

is on the verge of joining.

American efforts to fight terrorism in

the region also include non-military

programs, like instruction for teachers

and job training for young Muslim men

who could be singled out by militants’

recruiting campaigns. One goal of the

program is to act quickly in these

countries before terrorism becomes as

entrenched as it is in

Somalia,

an East African nation where there is a

heightened militant threat. And unlike

Somalia, Mali is willing and able to

have dozens of American and European

military trainers conduct exercises

here, and its leaders are plainly

worried about militants who have taken

refuge in its vast Saharan north. “Mali

does not have the means to control its

borders without the cooperation of the

United States,” Ibrahim Boubacar Keita,

a former prime minister, said in an

interview. Mali, a landlocked former

French colony that is nearly twice the

size of Texas with roughly half the

population, has a relatively stable,

though still fragile, democracy. But it

borders Algeria, whose well-equipped

military has chased Qaeda militants into

northern Mali, where they have adopted a

nomadic lifestyle, making them even more

difficult to track. |

|

|

POUND REGAINS LOST TERRITORY BUT

FOR TOURISTS ONE EURO EQUALS ONE POUND |

|

|

|

|

EMERGENCY AID

FOR EUROPEAN ECONOMY |

|

Prime Minister Gordon

Brown announced earlier this week a new

bailout for the British financial system

that increased government control over

lenders, saying it would offer banks

insurance on troubled assets. The

government also revised the terms of its

bailout of Royal Bank of Scotland,

raising its stake in the bank to 70

percent, from 58 percent. Governments in

Belgium, France, Germany, the

Netherlands and Spain have also

announced steps to bolster the capital

of their lenders. The continued economic

gloom extended to Spain, where the

National Statistics Institute said the

unemployment rate rose to 13.9 percent

in the fourth quarter, from 11.3

percent, which was already the highest

in the euro zone. The government said

last week that it expected unemployment

to rise to 16 percent this year, while

the economy would contract 1.6 percent.

Juan Carlos Martínez Lázaro, a professor

of economics at the IE Business School

in Madrid, said job losses had spread

from real estate and construction to

services and manufacturing, as consumers

spent less and Spain’s tourism season

ended. Mr. Martínez predicted that the

rise in unemployment would continue this

quarter, but ease in the second quarter

as local governments put into place an

8-billion-euro public works plan. “The

public works will help provide a lot of

jobs for four, five months,” he said.

“But it will only help up to a point.”

Still, there have been some slightly

more positive signs from the euro area

this week. An index of purchasing

managers on euro-area services and

manufacturing stood at 38.5 in January,

up from 38.2 in December, which was the

lowest reading since the survey began in

1998. Other reports this week — like the

January survey of consumer confidence in

Belgium and the ZEW survey on German

investor sentiment — have confounded the

more negative expectations of some

analysts. |

|

EURO

PUT STRAINS ON WEAKER ECONOMIES |

|

“The Italians, the

Spaniards, the Greeks, we all have been

living in happy land, spending what we

did not have,” said George Economou, a

Greek shipping magnate, contemplating

his country’s economic troubles and

others’ from his spacious boardroom. “It

was a fantasy world.” In Greece, another

of the euro zone nations in trouble,

stores like this one in Athens are

offering deep discounts to stay open.

For some of the countries on the

periphery of the 16-member euro currency

zone — Greece, Ireland, Italy, Portugal

and Spain — this debt-fired dream of

endless consumption has turned into the

rudest of nightmares, raising the risk

that a euro country may be forced to

declare bankruptcy or abandon the

currency. The prospect, however

unlikely, is a humbling one. The

adoption of the euro just a decade ago

was meant to pull Europe together

economically and politically, ending the

sometimes furious battles over who could

devalue their currency the fastest and

beggar their neighbour. |

|

|

|